Instructions For Income Withholding For Support Page 6

ADVERTISEMENT

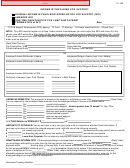

COMPLETED BY SENDER:

31.

Liability. Additional information on the penalty and/or citation of the penalty for an

employer/income withholder who fails to comply with the IWO. The state or tribal law/procedures

of the employee/obligor’s principal place of employment govern the penalty.

32.

Anti-discrimination. Additional information on the penalty and/or citation of the penalty for an

employer/income withholder who discharges, refuses to employ, or disciplines an

employee/obligor as a result of the IWO. The state or tribal law/procedures of the

employee/obligor’s principal place of employment govern the penalty.

33.

Supplemental Information. Any state-specific information needed, such as maximum

withholding percentage for nonemployees/independent contractors, fees the employer/income

withholder may charge the obligor for income withholding, or children’s names and DOBs if there

are more than six children on this IWO. Additional information must be consistent with the

requirements of the form and the instructions.

COMPLETED BY EMPLOYER/INCOME WITHHOLDER:

NOTIFICATION OF EMPLOYMENT TERMINATION OR INCOME STATUS

The employer must complete this section when the employee/obligor’s employment is terminated, income

withholding ceases, or if the employee/obligor has never worked for the employer.

34a-b. Employment/Income Status Checkbox. Check the employment/income status of the

employee/obligor.

35.

Termination Date. If applicable, date employee/obligor was terminated.

36.

Last Known Telephone Number. Last known (home/cell/other) telephone number of the

employee/obligor.

37.

Last Known Address. Last known home/mailing address of the employee/obligor.

38.

Final Payment Date. Date employer sent final payment to SDU/Tribal Payee.

39.

Final Payment Amount. Amount of final payment sent to SDU/Tribal Payee.

40.

New Employer’s Name. Name of employee’s/obligor’s new employer (if known).

41.

New Employer’s Address. Address of employee’s/obligor’s new employer (if known).

COMPLETED BY SENDER:

CONTACT INFORMATION

42.

Issuer Name (Employer/Income Withholder Contact). Name of the contact person that the

employer/income withholder can call for information regarding this IWO.

43.

Issuer Telephone Number. Telephone number of the contact person.

44.

Issuer Fax Number. Optional fax number of the contact person.

45.

Issuer Email/Website. Optional email or website of the contact person.

46.

Issuer Address (Termination/Income Status and Correspondence Address). Address to

_________________________________________________________________________________________________________

INCOME WITHHOLDING FOR SUPPORT – Instructions

Page 6 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7