Page 2

Plan name

EIN

Plan number

If the plan did not provide eligible employees with the opportunity to make elective deferrals and the plan provides for matching

contributions, the corrective matching contribution will be based on the assumption that the eligible employee would have made an

elective deferral equal to 3% of compensation.

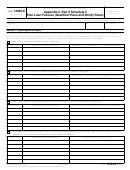

The total corrective contribution (before adjusting for Earnings) for each plan year is:

Year

Corrective Contribution

The Earnings calculation for an affected employee will be based on one of the following method(s) (check one):

Actual investment results of the affected employee’s SIMPLE IRA account.

The interest rate incorporated in the Department of Labor’s Voluntary Fiduciary Correction Program Online Calculator (“VFCP

Online Calculator”) ( ), since the actual Earnings of the affected employee’s IRA

account cannot be ascertained.

Actual investment results for years in which data for the affected employee is available, and the rate incorporated in the VFCP

Online Calculator for years in which the actual investment results of the affected employee’s IRA account cannot be

ascertained. The VFCP Online Calculator was or will be used for the following year(s):

Former employees affected by the failure (check one):

There are no former employees affected by the failure.

Affected former employees (or if deceased, their estate or known beneficiary) will be contacted, and corrective contributions

will be made to their SIMPLE IRA accounts. To the extent that an affected former employee or beneficiary cannot be located

following a mailing to the last known address, the Plan Sponsor will take the actions specified below to locate that employee or

beneficiary:

After such actions are taken, if an affected employee or beneficiary is not found but is subsequently located on a later date, the

Plan Sponsor will make corrective contributions to the affected SIMPLE IRA account at that time.

C. Failure to Provide Eligible Employees with the Opportunity to Make Elective Deferrals.

The Plan Sponsor did not provide employee(s) who satisfied the applicable eligibility requirements with the opportunity to make

elective deferrals to the SIMPLE IRA plan. The failure occurred for the following plan year(s):

Description of the Proposed Method of Correction

The Plan Sponsor has contributed (or will contribute) additional amounts to the plan on behalf of each affected employee. The

corrective contribution will be made to compensate the affected employee(s) for the missed deferral opportunity. The corrective

contribution on behalf of each affected employee is equal to 50% of what the employee’s deferral might have been had he or she

been provided with the opportunity to make elective deferrals to the plan. Since the employee’s deferral decision is not known, the

deferral amount is estimated by assuming that the excluded employee would have made an elective deferral equal to 3% of his or

her compensation. (Example: N, a nonhighly compensated employee was erroneously excluded from the plan. During the year of

exclusion, N made $10,000 in compensation. N’s missed deferral is estimated to be: 3% times $10,000 or $300. The required

corrective contribution on behalf of N, before adjusting for Earnings, is 50% of $300 or $150). Thus, the required corrective

contribution for an employee who was erroneously excluded from making elective deferrals from a SIMPLE IRA Plan is equal to

1.5% of compensation (adjusted for Earnings).

14568-D

Catalog Number 66148F

Form

(1-2014)

1

1 2

2 3

3 4

4 5

5 6

6