Page 4

Plan name

EIN

Plan number

Description of the Proposed Method of Correction (check all correction methods that apply):

Distribution of Excess Elective Deferrals

The Plan Sponsor has effected (or will effect) a distribution of the Excess Amounts, adjusted for Earnings through the date of

correction, to the affected participant(s). The Earnings adjustment will be based on the actual rates of return of the participant’s

SIMPLE IRA account from the date(s) that the excess deferrals were made through the date of correction.

Affected participants were (or will be) informed that the distribution of an Excess Amount is not eligible for favorable tax

treatment accorded to distributions from a SIMPLE IRA and, specifically, is not eligible for tax-free rollover.

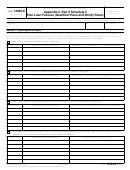

The total corrective distribution (before adjusting for Earnings) for each affected plan year is as follows:

Year

Corrective Distribution

Number of Participants Affected

Distribution of Excess Employer Contributions

The Plan Sponsor has effected (or will effect) the return of excess employer contributions, adjusted for Earnings through the

date of correction, to the Plan Sponsor. The Earnings adjustment will be based on the actual rates of return on the affected

participants’ SIMPLE IRA accounts from the date(s) that the excess employer contributions were made through the date of

correction. The amount returned to the Plan Sponsor is not includible in the gross income of the affected participant(s). The

Plan Sponsor is not entitled to a deduction for such excess employer contributions. The amount returned is reported on Form

1099-R as a distribution issued to the affected participant(s), indicating the taxable amount as zero.

The return of the excess employer contributions (before adjusting for Earnings) for each affected plan year is as follows:

Year

Return of Excess Employer Contributions

Number of Participants Affected

Retention of Excess Amounts

Note: If this correction method is selected, an additional VCP fee is required. (See section 12.06(2) of Rev. Proc. 2013-12.)

The Excess Amounts (including Earnings) were retained in the SIMPLE IRA accounts of the affected participants as follows:

Year

Excess Amounts Retained

Number of Participants Affected

14568-D

Catalog Number 66148F

Form

(1-2014)

1

1 2

2 3

3 4

4 5

5 6

6