Page 3

Plan name

EIN

Plan number

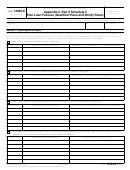

The total corrective contribution (before adjusting for Earnings) on behalf of the affected employees for each plan year is as follows:

Year

Corrective Contribution

The corrective contribution made on behalf of each affected employee will also be adjusted for Earnings. Earnings will be

calculated from the date(s) that the contribution(s) should have been made through the date of the corrective contribution. The

corrective contribution (adjusted for Earnings) will be made to each affected employee’s SIMPLE IRA account. If an affected

employee does not have a SIMPLE IRA account, a SIMPLE IRA account will be established for that employee. Earnings will be

calculated on the basis of one of the following methods (check one):

Actual investment results of the affected employee’s SIMPLE IRA account.

The interest rate incorporated in the VFCP Online Calculator, since the actual Earnings of the affected employee’s IRA

account cannot be ascertained.

Actual investment results for years in which data for the affected employee is available, and the rate incorporated in the VFCP

Online Calculator for years in which the actual investment results of the affected employee’s IRA account cannot be

ascertained. The VFCP Online Calculator was or will be used for the following year(s):

Former employees affected by the failure (check one):

There are no former employees affected by the failure.

Affected former employees (or if deceased, their estate or known beneficiary) will be contacted, and corrective contributions

will be made to their SIMPLE IRA accounts. To the extent that an affected former employee or beneficiary cannot be located

following a mailing to the last known address, the Plan Sponsor will take the actions specified below to locate that employee or

beneficiary:

After such actions are taken, if an affected employee or beneficiary is not found but is subsequently located on a later date, the

Plan Sponsor will make corrective contributions to the affected SIMPLE IRA account at that time.

D. Excess Amounts Contributed

The Plan Sponsor contributed Excess Amounts to the plan on behalf of participants as Follows (check boxes that apply):

Amounts were contributed in excess of the benefit the participants were entitled to under the plan.

Elective deferrals were made to the SIMPLE IRA in excess of the limitation under the terms of the SIMPLE IRA (e.g., the

applicable limit under § 408(p)(2)(E)).

The total of the Excess Amounts for each affected plan year was as follows:

Year

Excess Amounts

Number of Participants Affected

14568-D

Catalog Number 66148F

Form

(1-2014)

1

1 2

2 3

3 4

4 5

5 6

6