Sc Property Tax Exemption Application For Individuals Page 3

ADVERTISEMENT

Application for Exemption Instructions for Individuals

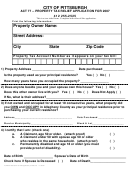

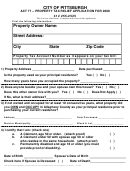

Individuals who are requesting a property tax exemption must complete Form PT-401-I (Application for Exemption).

Personal Property (Vehicle) Exemptions for Individuals

EXEMPTION SECTIONS:

Required documentation is listed for each exemption.

B(3) - Vehicle(s) exemption for Disabled Veterans

Two private passenger vehicles owned or leased by veteran who is totally and permanently disabled from a service

connected disability. Effective for tax year 2015, this exemption is allowed to surviving spouse for one vehicle owned or

leased for their lifetime or until their remarriage. Provide copies of the following: Certificate from Veterans Administration

or Local County Service Officer certifying total and permanent service connected disability with the effective date, copy of

vehicle(s) registration card, bill of sale or title. (VA Rating decision and e Benefits letters do not meet requirements of

law).

B(26) - Vehicle(s) exemption for Medal of Honor recipients

Two private passenger vehicles owned or leased by recipients of the Medal of Honor. Provide copies of the following:

Vehicle(s) registration card, bill of sale or title, certificate from Veterans Administration or Local County Service Officer

certifying receipt of Medal of Honor.

B(27) - Vehicle(s) exemption for persons required to use wheelchairs

Two personal motor vehicles, owned or leased either solely or jointly by persons required to use wheelchairs. Provide

copies of the following: Vehicle(s) registration card, bill of sale or title and a signed physician’s statement on physician’s

letterhead certifying the required use of wheelchair on a permanent basis with effective date of wheelchair use.

B(29) - Vehicle(s) exemption for Prisoner of War

Two private passenger vehicles or trucks, not exceeding three-quarter ton, owned or leased by prisoner of war (POW) in

World War I, World War II, the Korean Conflict, or the Vietnam Conflict. This exemption is allowed to surviving spouses of

a former POW for their lifetime or remarriage. Provide copies of the following: Vehicle(s) registration card, bill of sale or

title, certificate from Veterans Administration or Local County Service Officer certifying you were a Prisoner of War.

B(37) – Vehicle(s) exemption for parent or legal guardian of a minor child who is blind or requires the use of a

wheelchair

One personal motor vehicle owned or leased by a parent or legal guardian of a minor who is blind or requires the use of a

wheelchair when the vehicle is used to transport the minor. Provide copies of the following: Vehicle(s) registration card,

bill of sale or title, physician’s statement certifying the minor child is blind or required to use a wheelchair with effective

date and copy of original birth certificate showing parents name or court documentation of legal guardianship.

Real Property (Land and Home) Exemptions for Individuals

B(1)(A) - Dwelling home of a veteran who is permanently and totally disabled as a result of a service connected

disability

The house owned by an eligible owner (veteran) in fee or for life, or jointly with a spouse. This exemption is allowed to the

surviving spouse who owned the house in fee or for life or jointly with the now deceased spouse, if the spouse remains

unmarried, resides in the house, and owned the house in fee or for life. Provide copies of the following: Certificate from

Veterans Administration or Local County Service Officer certifying total and permanent service connected disability with

the effective date, copy of recorded deed and 4% legal residence form. (VA Rating decision and e Benefits letters do not

meet requirements of law.)

B(1)(B) - Dwelling home of a former law enforcement officer, who is permanently and totally disabled as a result

of a law enforcement service connected disability in this State

The house owned by an eligible owner (law enforcement officer) in fee or for life, or jointly with a spouse. This exemption

is allowed to the surviving spouse who owned the house in fee or for life or jointly with the now deceased spouse, if the

spouse remains unmarried, resides in the house, and owns the house in fee or for life. Provide copies of the following:

Copy of final order issued by Workers’ Compensation Commission of total and permanent service connected disability in

this State with the effective date, copy of recorded deed and 4% legal residence form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4