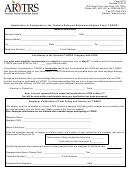

Part B. To Be Completed by the Employing Agency

Instructions to the Agency - This application is not to be used as a means for verifying service for leave, retention or other non-retirement purposes.

The procedures for verifying service for establishing creditability of service are contained in Chapter 20 of the CSRS/FERS Handbook. If more space is

needed for information requested in Item 3, please attach a separate sheet. Show the name and Social Security Number of the applicant on the separate sheet

(SF 2801-1 may be used for this purpose).

1.

Is the employee in a position subject to civil service retirement coverage?

2.

Exact date civil service retirement deductions began for the current appointment

(mm/dd/yyyy)

No

Yes

3.

Civilian Service Not Under a Retirement System for Federal Employees

From verified service documented in official personnel records, list any Federal civilian service not subject to a retirement system for Federal (or D.C.

Government) employees. If total basic salary earned for any such period is known, a summary entry may be entered on the right-hand side below.

Otherwise, show each change affecting basic salary during the period of service. Any period of nondeduction service claimed on the front of this form

which cannot be verified from official records should be listed and noted in the "Leave Without Pay" column as "Unverified." NOTE: This information

will also be requested (on the SF 2801-1) in connection with the employee's retirement. The agency should keep a copy of this schedule to facilitate

completion of the SF 2801-1.

If basic salary actually earned is available,

Basic

make summary entry below.

Salary basis

Nature of action

Effective date

Leave

salary rate

(per annum, per

(Appt., pro., res., etc.)

(mm/dd/yyyy)

without pay

From

To

Total

hour, WAE, etc.)*

(mm/dd/yyyy)

(mm/dd/yyyy)

Earned

* If part-time, provide the number of hours in the scheduled tour of duty and dates of each change in tour of duty. If employee claims to have worked more

than the scheduled tour(s), provide number of hours worked at each pay rate. If intermittent (WAE), provide the number of hours or days worked, if

available, at each pay rate.

Certification - The information entered above is based on official records of this agency and is correct. There is no official personnel or fiscal record

in this agency of the additional service (if any) alleged by the employee and marked "Unverified" in item 3.

Signature

Date (mm/dd/yyyy)

Agency address

Email address

Official title

Telephone number (including area code)

Fax number (including area

code)

(

)

(

)

Privacy Act and Public Burden Statement

Solicitation of this information is authorized by the Civil Service Retirement law (Chapter 83, title 5, U.S. Code). The information you furnish will be used to determine your

eligibility to make deposits or redeposits to the Civil Service Retirement and Disability Fund, to identify records properly associated with your application, to obtain additional

information if necessary, and to maintain a uniquely identifiable claim file. The information may be shared and is subject to verification, via paper, electronic media, or through

the use of computer matching programs, with national, state, local or other charitable or social security administrative agencies in order to determine benefits under their

programs, to obtain information necessary for determination or continuation of benefits under this program, or to report income for tax purposes. It may also be shared and

verified, as noted above, with law enforcement agencies when they are investigating a violation or potential violation of civil or criminal law. Executive Order 9397 (November

22, 1943) authorizes the use of the Social Security Number. Failure to furnish the requested information may delay or make it impossible for us to determine your eligibility to

make payments.

We estimate this form takes an average 30 minutes per response to complete, including the time for reviewing instructions, getting the needed data, and reviewing the

completed form. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time, to the Office of Personnel

Management (OPM), Retirement & Benefits Publications Team (3206-0134), Washington, DC 20415-3430. The OMB Number 3206-0134 is currently valid. OPM may not

collect this information, and you are not required to respond, unless this number is displayed.

Standard Form 2803

Revised April 2010

PRINT

SAVE

CLEAR

1

1 2

2 3

3 4

4 5

5 6

6