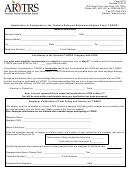

Information For Employee

Employee Instructions for Applying to Pay Post-1956 Military Service Deposit

•

Complete sections 1-16 on the front of the SF 2803, Application to Make Deposit or Redeposit.

•

Complete this form, SF 2803A, Application to Pay Military Deposit for Military Service Performed After December 31,1956.

•

Include a copy of your DD 214, Report of Transfer or Discharge, or equivalent record to verify your military service. If copies of the DD 214 are not

available, you should complete form SF 180, Request Pertaining to Military Records, and send it to the appropriate address (found on the form) to

verify your military service. You can obtain this form from your employing agency.

•

Attach documentation of military basic pay to this application. (See below)

•

Give the completed SF 2803, SF 2803A, and documentation noted above to your employing agency. Your agency will compute the military

deposit you owe and give you instructions for paying the deposit.

Employee Instructions for Completing this Form (SF 2803A)

•

Complete item 1 (Information About Employee's Military Service) by providing the branch of the military in which you served (e.g. Army, Navy,

etc.) and the dates of your military service. If you have more than one period of military service, make a separate entry for each period of military

service you performed. Note, a period of military service includes consecutive periods of service where there is no break in service. For military

purposes, a 1-day break separates service into two periods. Your agency will complete the section relating to the alternative deposit computation

rules and the interest accrual date.

•

Read the information in item 2 and then sign and date the form, and provide a telephone number and email address where you can be reached

during the day, at the bottom of item 2.

To Obtain Documentation of Military Basic Pay

Basic pay earnings may be documented by either of the following methods:

•

Actual pay records from the military service. Your agency can tell you what military pay records are acceptable for documenting actual military

earnings.

•

Estimated earnings, if you do not have official records of military earnings for the entire period of service. To obtain these estimated earnings from

the military, use RI 20-97, Request for Estimated Earnings During Military Service. You can obtain this form from your employing agency. You

must attach a copy of your DD 214 for the period of military service and any available records of pay and promotions. If the alternative deposit

calculation under USERRA applies to a period of military service, you should check with your agency for special instructions for requesting

estimated earnings if you received civilian pay (military leave, annual leave) during your period of military service.

The following records may not be used to document earnings:

•

Earnings statements from tax records. (They include allowances as well as basic pay.)

•

Social Security earnings statements. (They include allowances as well as basic pay and also reflect only military basic pay earned up to the Social

Security maximum wage base for withholding.)

Information For Employing Agency

Agency Instructions: The employing agency (or organization designated by the agency to administer the personnel records of the employee) must

complete the Agency Use Only section for every application before the action is processed through payroll. The agency must indicate if the period is

subject to the special comparative deposit calculation rules specified in the Uniformed Services Employment and Reemployment Rights Act (USERRA)

of 1994, as amended, by checking the appropriate block (Yes or No) under the Does Alternative Deposit Calculation Under USERRA Apply? column.

Do not leave that column blank. And, for each period of military service listed, the agency must provide the interest accrual date for the military deposit.

Finally, an authorized agency official should sign and date the certification section.

Reverse of Standard Form 2803A

April 2010

1

1 2

2 3

3 4

4 5

5 6

6