How Interest Is Computed on Deposits

How Interest Is Computed on Redeposits

Interest is computed on the redeposit from the date the refund

Interest is computed on the deposit from the midpoint of each

was paid.

period of nondeduction service.

•

•

Interest for nondeduction service performed before October

If the refund was based on an application received by the

1

1982, accrues daily and is charged at the following rates,

employing agency or OPM before October 1, 1982, interest on

,

compounded annually:

the redeposit accrues daily beginning on the date the refund

was paid and is charged at the following rates, compounded

•

4 percent through December 31, 1947; and

annually:

•

•

4 percent through December 31, 1947; and

3 percent from 1948 through the date the deposit is made

or to the commencing date of annuity, whichever is

•

earlier.

3 percent from 1948 through the date the redeposit is

made, or to the commencing date of annuity, whichever

Additional interest does not accrue if payment is made in full

is earlier.

within 30 days after the Office of Personnel Management

(OPM) issues the billing statement.

Additional interest does not accrue if full payment is made

within 30 days after the billing statement is issued.

•

Interest for nondeduction service performed on or after

•

October 1, 1982, accrues annually, is compounded annually

If the refund was based on an application received by the

on December 31 of each year, and is charged at the following

employing agency or OPM after September 30, 1982, interest

rates:

is charged beginning on the date the refund was paid, at the

following rates, compounded annually:

•

3 percent through December 31, 1984; and

•

3 percent through December 31, 1984; and

•

At a variable rate determined annually by the

•

A variable rate determined by the Department of

Department of Treasury beginning January 1, 1985. The

variable interest rate for any year equals the overall

Treasury beginning January 1, 1985. The variable rate for

average yield to the fund from retirement securities

any year equals the overall average yield to the fund from

during the preceding fiscal year.

retirement securities during the preceding fiscal year.

No interest is charged for a year when payment in full is

For post-September 30, 1982, refunds, interest is not charged

received by December 31 of that year.

for a year when payment in full is received by December 31

of that year.

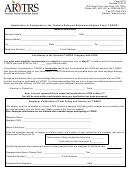

Procedures Governing Civil Service Retirement System (CSRS) Deposit And Redeposit

Deposits and redeposits can be made by employees now serving

Installment payments of at least $50 are acceptable. However,

under the CSRS, by separated employees who are entitled (or

interest accrues on the unpaid balance. You may authorize

would be entitled after paying for service) to an annuity, or by

direct debit payments. You will receive information about

eligible widows, widowers, or former spouses of deceased

how to authorize direct debit payments when you receive your

employees. An applicant for retirement is automatically given an

statement.

opportunity to make the deposit for nondeduction service

performed on or after October 1, 1982, and any redeposit when

Specify the service you want to pay for. Contact your

the application for retirement is processed. An applicant for

retirement counselor to discuss the advantages of paying for

retirement must specifically request an opportunity to make a

one period of service over another before you make your

deposit for nondeduction service performed before October 1,

decision. After you have paid in full for the period of service

1982. An employee should not file an application to make

you select, please notify us if you want us to bill you for any

deposit or redeposit if he or she contemplates retirement

other service.

within six months.

You cannot withdraw the payments you make unless you

If you are employed by the Federal or District of Columbia

become eligible for and obtain a refund of all your retirement

Government, you must send your completed application to your

deductions.

department or agency first because they must certify it.

Additional information and assistance in completing this

If you are separated from the Federal or District of Columbia

application may be obtained from the personnel office of

Government, send your completed application directly to the

the Government department or agency in which you are

Office of Personnel Management, Retirement Operations Center,

employed. If this source of information is not available to you,

Deposit Section, P.O. Box 45, Boyers, PA 16017-0045.

contact the Office of Personnel Management, Civil Service

Retirement System, Boyers, PA 16017-0045, or call us at

Instructions for making payment together with a statement for the

1-888-767-6738 (TDD: 1-800-878-5708) Monday through

amount due will be sent to you as soon as the processing of your

Friday from 7:30 AM to 7:45 PM Eastern Time.

application is completed.

Standard Form 2803

Revised April 2010

1

1 2

2 3

3 4

4 5

5 6

6