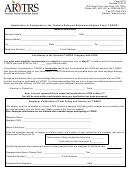

Information Regarding Deposit and Redeposit

Civil Service Retirement System

Detach this information sheet before filling out the application.

Read this information carefully before filling out the attached application.

Who Should Use This Application?

You should use this application if you are covered by the Civil Service Retirement System (CSRS) and you want to pay a deposit or a

redeposit for civilian service. You should not use this application if you are covered by the Federal Employees Retirement System (FERS).

Credit for Military Service Performed After December 31, 1956

To make payment for military service performed after December 31, 1956, refer to the instructions on SF 2803A, Application to Pay Military

Deposit, which is part of this package. Only current CSRS-covered employees may apply to pay military deposits.

What You Should Know About Deposit for Civilian Service Under CSRS

Deposit is a payment to the retirement fund to cover a period of

The amount of your deposit will be the percentage of your basic

civilian service during which no retirement deductions were

salary shown below, plus interest.

withheld from your salary (also called "nondeduction" service).

Deduction

Dates of Service

Rate

You do not have to make a deposit if you do not wish to do so.

However, if you do not make the deposit —

July 1, 1926, and June 30, 1942 ........................................... 3.50%

•

July 1, 1942, and June 30, 1948................................................. 5%

For nondeduction service performed before October 1,

1982, you will receive credit toward your retirement annuity.

July 1, 1948, and October 31, 1956 ........................................... 6%

Your annuity will be permanently reduced by 10% of the

November 1, 1956, and December 31, 1969 ........................ 6.50%

amount due as a deposit. For example, if a deposit of $600 is

January 1, 1970, and December 31, 1998 .................................. 7%

required and it is not paid, the annuity is permanently reduced

January 1, 1999, and December 31, 1999 ............................. 7.25%

by $60 a year (or $5 a month). On the other hand, if a deposit

January 1, 2000, and December 31, 2000 ............................. 7.40%

of $600 is made, it will increase the annuity by $60 a year.

After December 31, 2000 ........................................................... 7%

•

For nondeduction service performed on or after October

1, 1982, you will receive no credit in the computation of your

(Certain special categories of employees are subject to higher

annuity. The period of service will be creditable for title and

percentage deductions as specified in 5 U.S.C. 8334.)

average salary purposes whether or not a deposit is made.

What You Should Know About CSRS Redeposit

Redeposit is a payment to the retirement fund to cover a period of

If you do not pay the redeposit for this service, your annuity

service for which retirement reductions were withheld from your

will be permanently, actuarially reduced because the redeposit

salary and later refunded to you.

is not paid. The amount of the reduction will be based on

factors which will be divided into the amount of redeposit and

You do not have to make a redeposit if you do not wish to do so.

interest you owe at retirement.

However, if you do not make the redeposit —

•

If you retire on disability, you will not receive credit for

service with unpaid redeposits. This means that should you

•

For service which ended on or after March 1, 1991,

retire because of a disability, you could find that you must pay

you will receive no credit in the computation of your annuity

for the service to receive credit for it and that the accrual of

for the period of service covered by the refund. This usually

interest has increased the amount you must pay.

results in a reduction in the amount of your annuity, or, in the

event of death, your eligible widow's (or widower's) annuity.

The period of service will be creditable for title and average

The amount of redeposit will be the sum of the refund plus

salary purposes whether or not a redeposit is made.

interest from the date the refund was paid to the date of redeposit

(or commencing date of annuity, whichever is earlier).

•

For service which ended before March 1, 1991, if your

final separation occured on or after October 29, 2009, you

will receive credit in your annuity computation for the period

of service covered by the refund.

Standard Form 2803

Revised April 2010

1

1 2

2 3

3 4

4 5

5 6

6