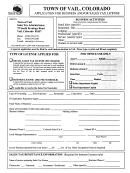

Application To Pay Military Deposit

For Military Service Performed After December 31, 1956

You must be currently employed and covered under CSRS to make the military deposit.

You must complete the deposit in full before the separation on which your retirement benefit will be based.

Employee's Name

Date of Birth (mm/dd/yyyy)

Social Security Number

1. Information About Employee's Military Service

To Be Completed By Employee

Agency Use Only (To Be Completed By Agency HR Office)

Interest Accrual Date (IAD)

Branch of Military

Period of Service

Does Alternative Deposit Calculation

(mm/dd/yyyy)

Under USERRA Apply?

(Check appropriate box)

Beginning Date

Ending Date

Yes

No

(mm/dd/yyyy)

(mm/dd/yyyy)

Certification:

The information entered above is based on official records of this

agency and is correct.

Date (mm/dd/yyyy)

Agency Official Signature

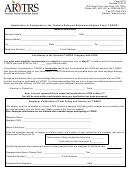

2. Employee's Acknowledgment of Understanding of Military Service Credit and Deposit Rules

I am currently employed in a position where deductions for the Civil Service Retirement System (CSRS) are being deducted from my salary, and I wish to

pay the deposit necessary to obtain credit for my military service after 1956. I understand that I must pay the entire deposit to my employing agency before

separation for retirement. I further understand that the military deposit cannot be deemed paid at retirement if I am eligible for and elect an alternative

annuity. If I do elect the alternative annuity upon retirement, any completed military deposits made to the Fund will be refunded to me along with any other

retirement contributions or payments I made to the Fund. Once I complete the deposit in full, I understand that it can only be refunded to me if I become

eligible for a refund of my retirement contributions or retire without waiving my military retired pay (if any).

I understand that for any given full period of military service that I have performed, if I do not complete the deposit for that full period of military service,

any payments I made that were applied to that full period of military service will be refunded to me when I retire or when I become eligible for a refund of

my retirement contributions. I also understand each of the following service credit rules and how they apply to any given full period of military service that

I have performed for which I have not completed the military deposit:

•

For each period of military service performed after 1956:

If the first time I worked in a position where CSRS deductions were withheld from my salary was on or after October 1, 1982, the post-1956

military service will not be used to compute or establish title to CSRS annuity if I do not complete the deposit before I separate for retirement.

If the first time I worked in a position where CSRS deductions were withheld from my salary was before October 1, 1982, the post-1956

military service will not be used to compute my annuity at age 62 (or when I retire, if I retire after age 62), if I am eligible for Social Security

benefits at that time.

Finally, I understand that payment of this deposit will not make my military service creditable if it is otherwise not creditable under CSRS.

I realize that the Office of Personnel Management (OPM) is solely responsible for adjudicating and administering civil service retirement benefits.

I understand that OPM will determine if my military service can be credited in my CSRS retirement when I apply for my retirement benefits.

Telephone number where you can be reached during the

Date (mm/dd/yyyy)

Employee's Signature

Email address

day

(

)

Standard Form 2803A

April 2010

PRINT

SAVE

CLEAR

1

1 2

2 3

3 4

4 5

5 6

6