Clear form

Print Form

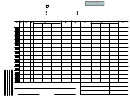

8f. Estimate your monthly total taxable gallons for each fuel type you checked.

50,000 or less

50,001-150,000

150,001-300,000

300,001 or more

1. Aviation fuel

2. Environmental assurance fee

3. Motor fuel

4. Special fuel

5. Compressed Natural Gas*

6. Liquefied Natural Gas**

7. Hydrogen***

* Estimate taxable gallons in gasoline gallon equivalents (GGE = 5.66 lbs.)

** Estimate taxable gallons in diesel gallon equivalents (DGE = 6.06 lbs.)

*** Estimate taxable gallons in gasoline gallon equivalents (GGE = 2.198 lbs.)

8g. General questions

We may deny your license if you do not answer all questions that apply to you.

1. Provide the state, supplier and estimated monthly gallons of fuel imports (attach additional sheets if necessary):

_ ___ _

_ __ _ __ _ _ __ _ __

__ _ _

a. Motor fuels

State importing from:

Supplier name:

Est. gallons per month:

__ ___

__ _ __ _ __ _ __ _ _

_ __ _

b. Diesel/biodiesel fuels

State importing from:

Supplier name:

Est. gallons per month:

_ ___ _

_ __ _ __ _ _ __ _ __

__ _ _

c. Aviation fuels

State importing from:

Supplier name:

Est. gallons per month:

_ ___ _

__ _ __ _ __ _ __ _ _

_ __ _

d. Other petroleum

State importing from:

Supplier name:

Est. gallons per month:

2. How will you report motor, aviation and diesel fuel gallons?

(The basis you choose must stay the same for the calendar year. You may only change your election on January 1.)

Gross election – actual meter amount

Net election – converted to 60 degrees

Section 9 – Mining Severance

9a. When will you start operations in Utah?

Month

Day

Year

Section 10 – Oil & Gas Conservation and Severance

USTC Use

10a. When will you start operations in Utah?

Only

Month

Day

Year

OGC

OGS

10b. DOGM Number

_ ___ ___ __ __ _ _

Issued by the Utah Department of Natural Resources:

Section 11 – Radioactive Waste

11a. When will your Utah facility begin operation?

Month

Day

Year

Page 6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8