Print form

Clear form

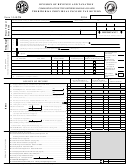

Utah Income Tax Return TC-40 (2004) Page 2

.

00

18. Enter tax (

full-year Utah resident, enter tax from line 16b - non or part-year resident, enter tax from line 17

)

18

19. Credit for income tax paid to another state (page 10). Attach form TC-40A. Nonresidents do not qualify.

.

00

19

20. Nonrefundable credits (pages 10 through 12 - add lines 20a through 20f and enter total nonrefundable credits on line 20)

AMOUNT

CODE

AMOUNT

CODE

.

.

00

20a

00

20b

.

.

00

00

20c

20d

.

.

.

20e

00

20f

00

00

20

If claiming Qualified Sheltered Workshop (

code 02

), write the Workshop name here:

__________________________________

.

00

21. Subtotal (add lines 19 and 20)

21

.

00

22. Subtract line 21 from line 18 (Note: if line 21 is greater than or equal to line 18, enter zero)

22

23.

Contributions

(pages 12 through 13 - add lines 23a through 23f and enter total contributions on line 23)

NOTE: SCH/TECH CODE used only for Nonprofit School District Foundation and Utah College of Applied Technology.

SCH/TECH

SCH/TECH

CODE

CODE

AMOUNT

CODE

AMOUNT

CODE

23a

23b

23d

23c

.

23f

23e

00

23

.

24. AMENDED RETURNS ONLY - previous refunds (page 13)

00

24

.

00

25. Tax from recapture of credits (page 13)

25

.

00

26. Utah use tax (page 13)

26

.

00

27. Total tax, use tax and additions to tax (add lines 22 through 26)

27

.

00

28.

UTAH TAX WITHHELD

(must attach Utah W-2 and/or 1099 forms) (page 14)

UTAH TAX WITHHELD

28

.

00

29. Credit for Utah income taxes prepaid (page 14)

29

.

00

30. AMENDED RETURNS ONLY - previous payments (page 14)

30

31. Refundable credits (pages 14 through 15 - add lines 31a through 31f and enter total refundable credits on line 31)

CODE

AMOUNT

AMOUNT

CODE

.

.

00

31a

00

31b

.

.

31c

00

00

31d

.

.

.

00

31e

00

31f

00

31

If claiming the nonresident shareholder's tax credit

(

code 43

), enter S corporation’s federal ID number

.

00

32

32. Total (add lines 28 through 31)

33. Tax due

- If line

27

is greater than line

32

, subtract line

32

from line

27 This is the amount you owe.

.

.

00

You will be billed for any penalty and interest owed. See page 15 about payment options.

33

TAX DUE

Use enclosed envelope or mail to Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0266

34. Refund

- If line

32

is greater than line

27

, subtract line

27

from line

32 This is your refund.

.

(page 15)

.

00

REFUND

34

Use enclosed envelope or mail to Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0260

35.

Enter the amount of refund you want applied to your 2005 taxes. Your refund will be reduced

Amount to be

.

00

by this amount.

If AMENDING, you cannot apply refund to 2005 tax liability.

(page 15)

35

applied to 2005

36. DIRECT DEPOSIT YOUR REFUND. Complete information below. (page 15)

Routing number

What type of account is it?

Account number

Checking

Savings

account

account

Under penalties of perjury, I declare to the best of my knowledge and belief, this return and accompanying schedules reflect my true tax status.

Your signature

Date signed

Date signed

Spouse' s signature (if filing jointly, both MUST sign even if only one had income)

SIGN

HERE

Designee' s telephone number

Designee' s personal ID number (PIN)

Name of designee (if any) you authorize to discuss this return with the Tax Commission (page 15)

Preparer' s signature (page 16)

Preparer' s Social Security no. or PTIN

Preparer' s telephone number

Firm' s name and address

Preparer' s EIN

40042

1

1 2

2