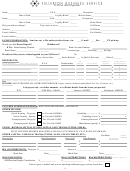

Universal Child Care Benefits (UCCB) – Is RC62 slip attached?

Yes

No

If the taxpayer is a single parent, is the UCCB designated to a dependant?

Yes

No

7.

General Income/Deductions

T4 slips – Employment income?

Yes

No

T4A – Commission and self-employment?

Yes

No

T4E – Employment insurance?

Yes

No

T5007 – Social assistance?

Yes

No

Employment income or taxable benefits not shown on the T4 slip?

__________________________________

Amount paid for union and professional dues and organization names?

__________________________________

List of child care expenses, with receipts, for each child?

Yes

No

List of moving expenses paid in the year?

Yes

No

List of support payments made or received?

Yes

No

List of deductible employment expenses?

Yes

No

Is a signed form T2200 attached?

Yes

No

8.

Pension Income

T4A – Pension, retirement and annuity income?

Yes

No

T4AP – Canada pension plan benefits?

Yes

No

T4A(OAS) Old age security pension slip/foreign pensions?

Yes

No

T4A(RCA) – Retirement compensation arrangements?

Yes

No

T4RSP – Registered retirement savings plan income?

Yes

No

T4RIF – Registered retirement income fund income?

Yes

No

Does the taxpayer elect to split eligible pension income with his/her spouse or

common-law partner?

Yes

No

9.

Investment Income/Deductions

T3 – Income from trust allocations?

Yes

No

T5 – Investment income?

Yes

No

T4PS – Income from profit sharing plans?

Yes

No

T5013/T5013(A) – Partnership income?

Yes

No

T5008 – Income from securities transactions?

Yes

No

Did the taxpayer dispose of property during the year? If so, provide the following details in a separate list:

Description of

Expenses for

Date Acquired

Date Disposed of

Sales Proceeds

Cost

Property

Disposal

Interest paid to earn

Rental fee on safety

Accounting/

investment income

______________

deposit box

_________________

legal fees

_______________

10.

Self-Employment/Business Income

Financial statement(s)/ schedule of revenue and expenses attached?

Yes

No

Has the taxpayer registered to be eligible for Employment Insurance special benefits?

Yes

No

1

1 2

2 3

3