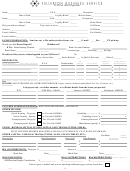

Tax Organizer Template For 2015 Page 2

ADVERTISEMENT

RENTAL INCOME

SCH A - DEDUCTIONS

HEALTH SAVINGS ACCOUNT - 1099SA

Type of Property and Address (List each property separately)

Amount

MEDICAL

Self

Yes

No

Doctors, Dentists, etc.

Mileage

Amount Paid

(a)

Family

Yes

No

(b)

(c)

Amount

(d)

1099-SA

RENTAL EXPENSES

(a)

(b)

(c)

(d)

Amount

EDUCATION CREDIT EXPENSES

Amount Paid

Advertising

Tuition Paid

Auto & Travel

Fees Paid

Cleaning & Maintenance

Books

Commissions

Student Loan Interest Paid

Total

Insurance

Total Medical Miles

Legal and other professional fees

HAVE - 1098T REQUIRED

Management fees

Drugs and Medications

Mortgage interest paid to banks

Hospital / Health Insurance Paid

Other interest

$

Miles to Old Job__________

TAXES

MOVING EXPENSES

Pest control

Miles to New Job_________

Amount Paid

Amount Paid

Repairs

State Income Tax

Expenses for Moving Household Goods

Real Estate Tax

Supplies

Travel from Old to New Residence

Personal Property Tax

Taxes

Lodging from Old to New Residence

Sales Tax, Vehicle, Boat, Home

Other (List)

Utilities

Sales Tax - New Vehicle

Other (list)

Make and Model

TOTAL

Purchase Price

Amount reimbursed by employer

CHILD CARE CREDIT

INTEREST

Amount Paid

Name of Qualifying Person

Date of Birth

Relationship

Length of Time Lived with You

Home Mortgage Interest - Financial Institutions

Home Mortgage Interest - Individuals

OVER ROAD TRUCKERS AND OUTSIDE SALES PERSONS

ID# or SS#

Relationship (if Any)

From

To

Paid

Other (List)

Person or Organization Caring for Child

Days Out

Name and Address

Qualified Mortgage Insurance Premiums

TRAVEL

Student Loans

Number of Business Miles Traveled

Total Miles Driven this Year

Service Stations, Markets, Various Stores, Self Employeed, Over Road Truckers, Hair Salons, Car Sales, etc.

Make of Vehicle

Year Purchased

CONTRIBUTIONS

Amount Paid

OFFICE IN HOME

SCH C - Profit or Loss from Business - 1099 MISC.

Church

(Sole Proprietorship) (Owner Operator)

Square Feet in Office

Amount

BUSINESS INCOME AND EXPENSES

BUSINESS EXPENSES

Goodwill Industries

(What you Paid Out)

COPE

Advertising

Name of Business

Red Cross

Car and truck expenses

or actual

EMPLOYEE BUSINESS EXPENSE

Federal ID #

Amount Paid

KARM

Commissioned Fees

BUSINESS SALES AND INCOME

Fares for airplane, boat, bus, taxi, etc.

Amount

Other (List)

Insurance

Meals & Tips

Gross Receipts from Business (Money you took in)

Interest mortgage (paid to banks, etc.)

Lodging

Return and Allowances

Interest - Paid to Others

Laundry

Inventory on Hand - Beginning of Year

Legal, Accounting, Tax Service

Other (List)

Merchandise Purchased for Resale

Charitable Miles Traveled

Office Expenses

Inventory on Hand - End of Year

Rent or Lease of Land & Buildings

Rent Vehicles, Machinery, and Equipment

Repairs and Maintenance

EQUIPMENT PURCHASED

Amount

Supplies

MISCELLANEOUS DEDUCTIONS

Amount Paid

Total

Taxes and Licenses

Union Dues

Amount reimbursed to you

Travel

Doby

Grand Total

Meals and Entertainment

Assessments

Utilities, Telephone, Cell phone

Books, Publications and Subscriptions

Wages

Tax Return Preparation Fee

TEACHERS

Other Expenses (List type and amount)

HEALTH INSURANCE PAID

Employment Firm Fees

Classroom Supplies

TOTAL BUSINESS EXPENSES

Uniforms

Professional Education

Safe Deposit Box

Other (List)

Teachers Supplies

Page 3

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2