12

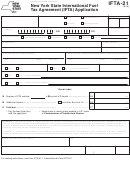

(1) NAME OF OWNER, PARTNER OR CORPORATE OFFICER

TELEPHONE NO.

(

)

– Include street, city, province/state, country and postal/zip code

RESIDENCE ADDRESS

(2) NAME OF OWNER, PARTNER OR CORPORATE OFFICER

TELEPHONE NO.

(

)

– Include street, city, province/state, country and postal/zip code

RESIDENCE ADDRESS

(3) NAME OF OWNER, PARTNER OR CORPORATE OFFICER

TELEPHONE NO.

(

)

– Include street, city, province/state, country and postal/zip code

RESIDENCE ADDRESS

13

DO YOU MAINTAIN BULK FUEL STORAGE IN OTHER JURISDICTIONS?

DO YOU MAINTAIN BULK FUEL

STORAGE IN BRITISH COLUMBIA?

If YES,

list jurisdictions:

YES

NO

NO

YES

14

(Applies only to carriers having additional fleets outside of BC)

ARE YOU REQUESTING CONSOLIDATED FLEET FUEL REPORTING?

If YES, please send written request to BC's Commissioner as well as to the

YES

NO

commissioner(s) of the other jurisdiction(s) for which you wish to make consolidated reports.

– Check ( ✔ ) all that apply

15

INDICATE TYPE OF FUEL USE

DIESEL

GASOLINE

PROPANE

GASOHOL

NATURAL GAS

16

IFTA DECALS

Two decals (one set) are required for each qualified motor vehicle. Unless the

NUMBER OF

NUMBER OF

number requested is unusually large, the branch will issue the number of decals

QUALIFIED

SETS OF DECALS

that a carrier considers necessary for its business operations. Please indicate

MOTOR VEHICLES

REQUIRED

the number of qualified motor vehicles and the number of decals you require.

17

FEES

FEE

For new IFTA applicants, the one-time registration fee is $300. For IFTA renewals, the annual fee is $100.

$

Please remit applicable fee with this form and make cheque payable in Canadian dollars to the Minister of

Finance.

CERTIFICATION BY APPLICANT

18

The Applicant agrees:

• to comply with the reporting, payment, record keeping and licence and decal display requirements specified in the

International Fuel Tax Agreement. Failure to comply with these provisions may result in suspension or

cancellation of the Applicant's licence.

• that it is responsible for ensuring that the decals issued are properly distributed and accounted for in quarterly

reporting for audit purposes.

• that the Province of British Columbia may withhold any refunds due to the Applicant if the Applicant is delinquent

on payment of fuel taxes to any jurisdiction that is a signatory to the International Fuel Tax Agreement.

• that the information contained on this application may be shared with other British Columbia goverment agencies,

and with other governments and other agencies, insofar as that disclosure relates to the administration and

enforcement of taxation enactments or the International Fuel Tax Agreement.

• that the statements made in this application are true and complete to the best of the Applicant's knowledge.

NAME AND TITLE – PLEASE TYPE OR PRINT

SIGNATURE

DATE SIGNED

YYYY / MM / DD

(1)

(2)

(3)

FIN 363 (Reverse) Rev. 2004 / 10 / 8

Clear Form

1

1 2

2