Form W-1 - Employer'S Return Of Tax Withheld Page 4

ADVERTISEMENT

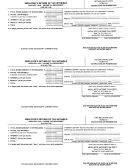

RECONCILIATION OF WEST CARROLLTON

FORM W-3

INCOME TAX WITHHELD

MAIL TO: CITY OF WEST CARROLLTON

West Carrollton Income Tax paid during

DIVISION OF TAXATION

January ............... $

July...................... $

300 E. CENTRAL AVE.

February.................

August....................

WEST CARROLLTON, OHIO 45449-1810

March*....................

September* ............

April........................

October ..................

1. Total number of employees per W-2’s ..............

May ........................

November ..............

2. West Carrollton total wages per W-2’s .............

June* ......................

December* .............

3. West Carrollton tax withheld per W-2’s ............

4. West Carrollton tax paid....................................

TOTAL ................ $

5. Difference – balance due/(refund) ....................

Payment/refund not required if less than $2.00

I hereby certify that the information and statements contained herein are true,

correct, and complete.

Signed

Title

Date

*The monthly breakdown is not required for taxpayer’s filing quarterly.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4