Form W-1 - Employer'S Return Of Tax Withheld Page 2

ADVERTISEMENT

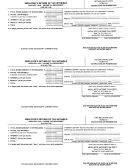

Form W-1

Return with Payment

EMPLOYER’S RETURN OF TAX WITHHELD

Vandalia • Brookville • Union • Clayton • West Milton • Butler Township JEDD • Butler Township JEDZ • Clay Township-Clayton JEDD

CITY OF

CITY OF

CITY OF

CITY OF

VILLAGE OF

VANDALIA

BROOKVILLE

UNION

CLAYTON

WEST MILTON

1. Payroll this period ……………………………….

2%

1.75%

1%

1.5%

1.5%

2. Tax ………………………………………………

3. Adjustment (provide explanation) ………………

4. Amount remitted (each city) …………………….

BUTLER TWP

BUTLER TWP

CLAY TWP-

JEDD

JEDZ

CLAYTON JEDD

1. Payroll this period ……………………………….

2%

1%

1.5%

2. Tax ………………………………………………

3. Adjustment (provide explanation) ………………

4. Amount remitted (each city) …………………….

TOTAL REMITTANCE …………………………………… $

I hereby certify that the information and statements contained herein are true and correct.

For period ending __________________ Due on or before ___________________

Account #_________________________

Federal ID # _______________________

Signed _________________________________________________________________

Official Title ___________________________________ Date ____________________

Name ________________________________________________________________

Please make check or money order payable to: CITY OF VANDALIA

Address ______________________________________________________________

Mail to: VANDALIA TAX OFFICE

_____________________________________________________________________

PO BOX 727

Phone # ______________________________________________________________

VANDALIA, OH 45377-0727

Is this a courtesy withholding? …………………………………

Yes /

No

ONLINE FILING AND PAYMENTS CAN BE

Is this a final return? …………………………………………….

Yes /

No

MADE ON OUR WEBSITE:

Amended? ………………………………………………………

Yes /

No

Please attach explanation if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2