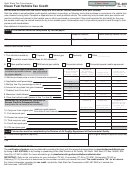

Arizona Form 313 - 2000 Alternative Fuel Vehicle (Afv) Credit Page 4

ADVERTISEMENT

F

o

r

m

3

1

3

F

o

r

m

3

1

3

Line 1 -

120, also enter this amount on Arizona Form 120, page 2, Schedule

B, line B8.

Enter one-third of the subtraction allowable from taxable year 1998.

Part II – Credit Eligibility

This is the sum of the amounts shown on Part I, lines 12, 21, and 24,

of the 1998 Arizona Form 313 filed with your 1998 Arizona income

See the section titled “Eligibility Requirements” on page 1 of these

tax return.

instructions for criteria that you must meet to claim the credit.

Line 2 -

Part III – Credit Intent Notice

If you conveyed the title to your qualifying vehicle to another

individual, corporation, partnership, estate, or trust, you cannot take

Answer the question on line 4. Check the box for the answer that

the subtraction for that vehicle in any subsequent taxable year.

applies to you.

To be eligible for an AFV credit, you must have filed Arizona Form,

Enter the unallowable amount on line 2. Attach a schedule to your

Notice of Intent to Claim Alternative Fuel Tax Credit or Opt Out

return that shows your computations and identifies each vehicle for

Payment , to the Office of Alternative Fuel Recovery/Department of

which you computed an unallowable amount. In order to properly

Revenue. You must have filed this form by January 2, 2001. If you

identify each vehicle, your schedule must show both of the following.

mailed this form, your form had to have been postmarked by January

1.

The taxable year in which you purchased or converted your

2, 2001.

You may also have used a private delivery service

qualifying vehicle.

designated by the IRS to meet the “timely mailing as timely filed

rule”.

2.

The vehicle identification number.

If you were unable to file the intent notice by the January 2, 2001

The following example will illustrate how to compute the unallowable

deadline, but feel that you are entitled to the credit, you may file Form

amount.

313 with an explanation of why you did not file the intent form by the

Example:

deadline. If the department disallows your credit, you will be billed

John, an individual taxpayer, purchased two new qualifying AFVs

for any tax, penalty and interest that results from that disallowance.

during 1998 at a cost of $36,000 each, for a total cost of $72,000.

To avoid penalty and interest charges, you can file your original return

For the 1998 taxable year, John computed a total subtraction of

without claiming the credit, then file an amended return to claim the

$18,000 ($9,000 for each vehicle). Since John could only take

credit.

one-third of the total $18,000 subtraction on his 1998 return, John

Part IV – Grant Information

took a subtraction of $6,000 on his 1998 return.

During December of 1998, John sold vehicle #1 to another

Lines 5 through 7 -

individual. Since John does not own vehicle #1 any longer, John

cannot take the remaining two-thirds of the original $9,000

Line 5 -

subtraction allowed for vehicle #1.

John computes the

Answer the question on line 5. To be eligible for an AFV credit, you

unallowable amount for vehicle #1 as follows:

must first apply for a grant from the Arizona Department of

Vehicle #1 subtraction

$ 9,000

Commerce Energy Office. If you answered no, STOP. You do not

Less amount taken for vehicle #1 in 1998

3,000

qualify for the credit.

Total unallowable amount

$ 6,000

Line 6 -

Since John may still take a subtraction for vehicle #2 on his 2000

Arizona return, John must allocate the unallowable amount for

If you answered yes to the question on line 5, answer the question on line

vehicle #1 between taxable years 1999 and 2000 as follows.

6. To be eligible for the credit for a vehicle that you purchased or

Unallowable amount allocable to 1999

$ 3,000

converted, you must have received a notice, or affidavit from the Arizona

Unallowable amount allocable to 2000

$ 3,000

Department of Commerce Energy Office. To be eligible for the credit for a

When John completes Form 313, John will enter 6,000 on Part I,

vehicle that you leased, you must have received an AFV verification from

line 1. Since $3,000 of the unallowable amount is allocable to

the Arizona Department of Commerce Energy Office. If you applied for a

2000, John will enter $3,000 on Part I, line 2 of his Arizona Form

grant, but did not receive a notice, affidavit, or an AFV verification, STOP.

313.

You do not qualify.

Line 3 -

Line 7-

Subtract line 2 from line 1. Enter the result on line 3.

If the vehicle is a leased vehicle, answer the question on line 7.

Individuals also enter this amount on Form 140, page 2, line C23;

General Credit Information

Form 140PY, page 2, line D35; or Form 140NR page 2, line D27.

The credit amount under A.R.S. § § 43-0186.B or 43-1174.B is

Estates or trusts filing an Arizona Form 141 also enter this amount on

figured as a percentage of the cost of the vehicle or a set dollar

Form 141, line 11e.

amount, whichever is more. Further, the amount of the credit is also

Partnerships filing Arizona Form 165 also enter this amount on

based on the vehicle emission classification, gross vehicle weight and

Arizona Form 165, page 2, Schedule B, line B4.

whether the vehicle is a new vehicle or a used vehicle.

Corporations filing Arizona Form 120A, enter this amount on Arizona

Vehicle Emission Levels

Form 120A, page 2, Schedule B, line B8. Corporations filing Form

The chart below shows the vehicle emission levels that qualify for a credit.

4

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7