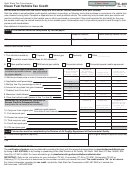

Arizona Form 313 - 2000 Alternative Fuel Vehicle (Afv) Credit Page 7

ADVERTISEMENT

F

o

r

m

3

1

3

F

o

r

m

3

1

3

Check box 109a if you are electing a lump sum refund.

Check box 109b if you are electing the refund be paid in two annual

installments.

Check box 109c if you are electing the refund be paid in three annual

installments.

Line 110 -

Individuals and corporations, including S corporations that elected to

take the credit, enter the amount from Part X, line 96, or if a lessor,

from part XI, line 98d or if a lessee, from Part XI, line 101. S

corporation shareholders, enter the amount from Part XII, line 105.

Partners of a partnership, enter the amount from Part XIII, line 108.

Line 111 -

Enter the tax from your 2000 income tax return, less any other tax

credits that you are claiming. Do not include the AFV credit from

Form 313.

Line 112 -

Subtract line 111 from line 110.

Line 113 -

In column (b), enter the credit originally computed for the taxable year

entered in column (a). In column (c), enter the amount of the credit

If the amount on line 111 is more than the credit being claimed on

from that taxable year which you have already used. Subtract the

Form 313, enter the amount from line 110 here.

amount in column (c) from the amount in column (b) and enter the

If you checked box 109a, enter the amount from line 110 here. If you

difference in column (d). Add the amounts entered on lines 114

checked box 109b, divide the amount on line 112 by 2 and add the

through 116c in column (d). Enter the total on line 117, column (d).

result to the amount on line 111 and enter the total on line 113. If you

Corporations and S corporations that elect to take the credit also enter

checked box 109c, divide the amount on line 112 by 3 and add the

the amount on line 117 on Arizona Form 300, Part I, line 8.

result to the amount on line 111 and enter the total on line 113.

Individuals also enter the amount on line 117 on Arizona Form 301,

Individuals also enter this amount on Form 140, page 1, line 38, or

Part I, line 9.

Form 140PY, page 1, line 39, or Form 140NR, page 1, line 38, or

Form 140X, page 1, line 38.

NOTE Individuals Only : If you are married, and you and your

NOTE Individuals Only : If you are married, and you and your

spouse file a separate return, you may each take only one-half of the

spouse file a separate return, you may each take only one-half of the

total credit that would otherwise be allowed on a joint return.

total credit that would otherwise be allowed on a joint return.

Where Should I Mail My Return?

Corporations also enter this amount on Form 120, page 1, line 25, or

Attach this form to your Arizona income tax return, and mail your return

Form 120A, page 1, line 17, or Form 120X, page 1, line 25.

to: Arizona Department of Revenue, PO Box 29206, Phoenix AZ 85038-

S corporations that are taking the credit also enter this amount on

9206. Do not mail your return to the address indicated on the tax return.

Form 120S, page 1, line 21.

Part XVI – Credit Carryover Available From

Taxable Years 1995, 1996, 1997, 1998, and 1999

Lines 114 Through 117 -

Use lines 114 through 117 to figure your total available credit

carryover from taxable years 1995, 1996, 1997, 1998, and 1999.

Complete lines 114 through 117 only if you claimed an AFV credit on

a prior year return for 1995, 1996, 1997, 1998, and 1999, and the

credit was more than your tax.

7

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7