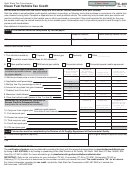

Arizona Form 313 - 2000 Alternative Fuel Vehicle (Afv) Credit Page 3

ADVERTISEMENT

F

o

r

m

3

1

3

F

o

r

m

3

1

3

•

The vehicle must be self-propelled and registered and titled in Arizona

Liquefied petroleum gas

•

for operation on highways. AFVs include bi-fuel vehicles and

Natural gas

dedicated vehicles. A neighborhood electric vehicle (NEV) is not an

•

Hydrogen

AFV for the purpose of the credit claimed on Form 313. However,

•

A blend of hydrogen with liquefied petroleum or natural gas that

see Form 328 for information concerning a NEV credit. Vehicles like

complies with either of the following:

golf carts, (even if used as a means of secondary transportation),

motorized wheelchairs, or vehicles designed primarily for agricultural

1.

Is used in an engine that is certified to meet at a minimum

purposes are not AFVs for this credit. AFVs also do not include

the United States Environmental Protection Agency low

vehicles like forklifts that are not designed primarily for operation on

emission vehicle standard under 40 Code of Federal

highways.

Regulations Section 88.104-94 or 88.105-94.

For a vehicle to qualify for a credit, the vehicle engine must meet one

2.

Is used in an engine that is certified by the engine modifier

of the following:

to meet the addendum to memorandum 1-A of the United

States Environmental Protection Agency.

1.

The vehicle engine is certified to meet at a minimum the United

•

States Environmental Protection Agency low emission vehicle

A combination of at least 70 percent alternative fuel and not

standard under 40 Code of Federal Regulations section 88.104-

more than 30 percent petroleum based fuel and that operates in

94, or 88.105-94.

an engine that meets the United States Environmental Protection

2.

The vehicle engine meets the requirements of the addendum to

Agency low emission vehicle standard under 40 Code of Federal

memorandum 1-A, issued by the United States Environmental

Regulations Section 88.104-94, or 88.105-94 and is certified by

Protection Agency, as printed in the Federal Register, Volume

the engine manufacturer to consume at least 70 percent

62, Number 207, October 27, 1997, pages 55635 through

alternative fuel during normal vehicle operations.

55637.

Line-by-Line Instructions

3.

The vehicle engine is the subject of a waiver for that specific

engine application from the United States Environmental

Enter the names and taxpayer identification numbers (TIN) as shown

Protection Agency's Memorandum 1-A requirements and that

on Form 140, 140PY, 140NR, 140X, 141 (subtraction only), 120,

waiver is documented to the reasonable satisfaction of the

120A, 120S (credit only), 120X, or 165. Fiscal year basis taxpayers

Arizona Department of Commerce, Energy Office.

must indicate the period covered by the taxable year. Attach the

completed form to the tax return.

If you have questions about whether your vehicle meets one of these

requirements, contact the manufacturer of your vehicle.

All returns, statements, and other documents filed with the

Department of Revenue require a taxpayer identification number

Are There Special Requirements for Leased

(TIN). The TIN is either a correct social security number or, for a

Vehicles?

business, the federal identification number. Paid tax preparers must

•

also include their TIN on forms where requested. Taxpayers and paid

A taxpayer that leases an AFV must apply for a grant from the

preparers who fail to include the preparer TIN may be subject to a

Arizona Department of Commerce even though the lessee is not

penalty.

Please check the return to be sure that all required

eligible for a grant. In this case, the Arizona Department of

identification numbers are accurate and written clearly. Missing,

Commerce will issue the person an AFV verification. The lessee

incorrect, or unclear identification numbers may cause delays in

must apply for a grant in order for the lessee and the lessor to be

processing the returns.

eligible to share the credit, unless the lessee is a governmental

agency.

Part I - Subtraction Allocable to Taxable Year

•

2000 From Taxable Year 1998

A taxpayer that leases an AFV may not claim a credit for the

incremental cost difference.

The alternative fuel subtraction was repealed in 1999. Therefore, you

•

A taxpayer that leases an AFV must reduce the amount of credit

may not take a subtraction for AFVs purchased or converted during

allowable under A.R.S. § § 43-1086.B or 43-1174.B by the

2000.

You may not take a subtraction for refueling equipment

amount of any grant received by the lessor.

purchased during 2000.

However, if you were entitled to a

•

subtraction for refueling equipment or vehicles purchased or

A person who purchases an AFV and then leases the vehicle to a

converted during 1998, you may still take one-third of the subtraction

governmental entity is entitled to take a tax credit for the

from 1998 which is allocable to 2000.

purchase of the vehicle.

•

NOTE: Skip lines 1 through 3 if you do not have a subtraction

A taxpayer that purchases an AFV for the purpose of leasing the

allocable to the 2000 taxable year from taxable year 1998.

vehicle cannot take an AFV credit for purchasing the vehicle.

However, the purchaser may split the credit allowed for the lease

Only

individuals,

partnerships,

corporations

(other

than

S

of the vehicle with the lessee.

corporations), estates and trusts may take the subtraction. An S

What is Alternative Fuel?

corporation cannot take the subtraction.

Alternative fuel is:

Use lines 1 through 3 to determine the portion of the total

•

allowable subtraction for purchases or conversions made in

Electricity

taxable year 1998 that is allocable to the 2000 taxable year.

•

Solar Energy

3

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7