Clear Page 3

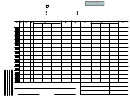

Section 2 – Sales and Use Tax

Sales and use tax is reported on TC-62 returns and schedules. For additional sales and use tax information, see Tax Commission

Pub 25 available on our website at tax.utah.gov/forms. To find sales tax rates, go online at tax.utah.gov/sales/rates.html.

NOTE: Goods or services purchased tax free, but used or consumed by you or your business, must be reported on line 4 of the sales and use tax

return. You must pay sales or use tax on goods you consume.

2a. When will you start selling or making purchases?

2b. Estimate your annual net sales and purchases subject to tax.

$16,000 or less

Month

Day

Year

$16,001 - $800,000

$800,001 - $1,500,000

$1,500,001 or more

Check this box to voluntarily file monthly:

2c. Sales and Use Tax

Read and review all questions. Check all boxes for which your answer is "yes."

Office Use

Only

1.

Will you sell goods or services from only one fixed place of business in Utah?

2.

Will you sell goods or services from more than one fixed place of business in Utah?

2. A

• If yes, complete and attach form TC-69B, listing each place of business.

3.

Will you sell goods or services from a non-fixed place of business, such as door-to-door or through

3. B

vending machines or multi-level marketing? Also check this box if your business is located in Utah and

you ship goods from a location outside Utah to a Utah customer.

4.

Are you a real property contractor having material delivered directly to a Utah job site from a location outside Utah?

4. B

5.

Are you a seller who has no physical or representational presence in Utah who is selling goods or services

5. N

shipped direct by U.S. mail or common carrier to Utah customers? See Pub 37, Business Activity and Nexus in Utah.

6.

Will you have sales of food and food ingredients? See Pub 25 for the definition of food.

6. G

7.

Will you sell motor vehicles, aircraft, watercraft, manufactured homes, modular homes or

mobile homes in municipalities imposing the resort communities tax?

7. X

Jurisdictions imposing the resort communities tax: Alta, Boulder, Brian Head, Bryce Canyon,

Garden City, Green River, Kanab, Midway, Moab, Monticello, Orderville, Panguitch, Park City,

Park City East, Springdale, Tropic

8.

Are you a utility providing telephone service, electricity or gas?

8. U

• If yes, complete and attach form TC-61Q.

9.

Will you have retail sales of new tires? This includes new tires sold as part of a vehicle sale,

new tires purchased on or for vehicles that are rented, or new tires purchased from all those not

collecting the Waste Tire Recycling Fee.

9. W

10.

Are you selling or operating motel, hotel, trailer court, campground or other lodging accommodations?

10. T

11.

Are you a restaurant? See Pub 25 for the definition of restaurant.

11. F

12.

Will you rent motor vehicles (registered for 12,000 pounds or less) to customers for 30 days or less?

12. L

13.

Will you purchase goods or services tax free from sellers located outside Utah for storage, use

or consumption by you or your business in Utah and need to report use tax of more than $400 annually?

If an answer to any question above changes, notify the Tax Commission.

Temporary License for Special Events

Regardless of whether you have a permanent sales tax license, all

county fairs, festivals, antique shows, gun shows, food shows, art

persons or sellers who participate in a one-time event or an event

shows, auctions, mall kiosks, swap meets, conventions, hobby

that runs six months or less where sales occur are required to

shows, seasonal stands found in malls, and other similar events.

obtain a temporary sales tax license.

Registering for a temporary license is easy. Register online at

These special events are generally removed from a seller's usual

tax.utah.gov/sales/specialevents.html, or call (801) 297-6303,

or toll free (outside the SLC area), 1-800-662-4335, ext. 6303.

location and fall under a variety of situations, including state and

1

1 2

2 3

3 4

4