Form Reg-1 - Business Taxes Registration Application Page 5

ADVERTISEMENT

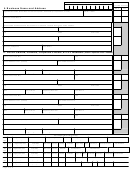

12.Room Occupancy Tax

Room occupancy tax is charged on the rental of a room for lodging purposes in

a hotel, motel, or rooming house in Connecticut, for 30 consecutive days or less.

Do you rent lodging rooms in a hotel, motel, or rooming house in Connecticut

for 30 consecutive days or less? ...................................................................................................

Yes

No

If you answered Yes to the room occupancy tax question, enter the date you

__ __ - __ __ - __ __

will start to rent rooms for lodging purposes in Connecticut: ...................................................

m

m

d

d

y

y

13. Dry Cleaning Surcharge

A dry cleaning surcharge is imposed on the gross receipts of retail sales of dry

cleaning services that use tetra chlorethylene, stoddard solution, or other chemicals.

Are you a dry cleaning establishment in Connecticut and use chemicals to dry clean clothes? ....

Yes

No

Do you accept clothing to be cleaned by other establishments using chemicals? .........................

Yes

No

If you answered Yes to either of the dry cleaning surcharge questions, enter the date

__ __ - __ __ - __ __

you will start to operate a dry cleaning establishment in Connecticut: ........................................

m

m

d

d

y

y

14.Tourism Surcharge

A tourism surcharge is imposed, by the rental or leasing company, on the rental or

lease of a passenger motor vehicle in Connecticut (regardless of where the vehicle

is used) for 30 consecutive days or less.

Do you rent or lease passenger motor vehicles in Connecticut for 30

consecutive days or less? .............................................................................................................

Yes

No

If you answered Yes to the tourism surcharge question above,

enter the date you will start renting or leasing passenger motor

__ __ - __ __ - __ __

vehicles in Connecticut: .............................................................................................................

m

m

d

d

y

y

15. Motor Vehicle Rental Surcharge

A motor vehicle rental surcharge is imposed, by the rental or leasing company, on

the rental or lease of a passenger motor vehicle or rental truck in Connecticut

(regardless of where the vehicle is used) for 30 consecutive days or less when the

company is primarily engaged in renting or leasing of passenger motor vehicles or

rental trucks.

Are you primarily engaged in the business of renting or leasing passenger

motor vehicles or rental trucks in Connecticut for 30 consecutive days or less? ...........................

Yes

No

If you answered Yes to the motor vehicle rental surcharge question,

enter the date you will start renting or leasing passenger motor

__ __ - __ __ - __ __

vehicles or rental trucks in Connecticut: .....................................................................................

m

m

d

d

y

y

16.Business Entity Tax

For taxable years beginning on or after January 1, 2002, a business entity tax

applies to the following business types that are required to file an annual report with

the Connecticut Secretary of the State:

• S corporations;

• Limited liability companies (LLCs or SMLLCs) — any limited liability company

that is, for federal income tax purposes, either:

• Treated as a partnership, if it has two or more members; or

• Disregarded as an entity separate from its owner, if it has a single member;

• Limited liability partnerships (LLPs); and

• Limited partnership (LPs).

Are you a business entity as described above? ........................................................................

Yes

No

If you answered Yes to the business entity tax question,

__ __ - __ __ - __ __

enter the date of organization: ................................................................................................

m

m

d

d

y

y

Enter the month of your fiscal year end:

Page 7 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6