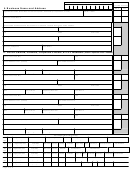

Form Reg-1 - Business Taxes Registration Application Page 3

ADVERTISEMENT

7. Income Tax Withholding

Employers, as well as payers of non-payroll amounts, may be required to register

with DRS to withhold the Connecticut income tax.

Are you an employer that transacts business or maintains an office in

Connecticut and that intends to pay wages? ..................................................................................

Yes

No

If you have a Connecticut tax registration number for withholding for another

location and intend to file withholding for this new location under that number,

enter that number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

and skip to Section 8; otherwise continue.

Are you an out-of-state company voluntarily registering to withhold Connecticut

income tax for your Connecticut resident employees? ...................................................................

Yes

No

Do you intend to withhold Connecticut income tax from any of the following:

pension plans; annuity plans; retirement distributions; or gambling distributions? .........................

Yes

No

Do you pay nonresident athletes or entertainers for services they render in Connecticut? ............

Yes

No

Do you only have household employees and wish to withhold Connecticut income tax? ...............

Yes

No

Do you only have agricultural employees and wish to withhold Connecticut income tax? .............

Yes

No

If Yes, do you file federal Form 943, Employer’s Annual Tax Return for Agricultural

Employees, and wish to file Form CT-941, Connecticut Quarterly Reconciliation of

Withholding, annually? ...................................................................................................................

Yes

No

If you answered Yes to any of the income tax withholding questions,

__ __ - __ __ - __ __

enter the date you will start withholding Connecticut income tax: ..............................................

m

m

d

d

y

y

If you use a payroll service, enter name of payroll company: ____________________________________________

8. Sales and Use Taxes

If you sell or lease goods or taxable services in Connecticut, you are required

to register for sales and use taxes.

Do you sell, or will you be selling, goods in Connecticut (either wholesale or retail)? ....................

Yes

No

Do you rent equipment or other tangible personal property to individuals or

businesses in Connecticut? ..............................................................................................................

Yes

No

Do you serve meals or beverages in Connecticut? ........................................................................

Yes

No

Do you provide a taxable service in Connecticut? (See the Informational Publication,

Getting Started in Business, for a list of taxable services.) ............................................................

Yes

No

If you answered Yes to any of the sales and use taxes questions,

__ __ - __ __ - __ __

enter the date you will start selling or leasing goods or taxable services: ..................................

m

m

d

d

y

y

9. Cigarette Dealer’s License

(Over the counter sales - non-vending machines)

A Cigarette Dealer’s License is required by those making retail, over the counter

sales of cigarettes, at an establishment located in Connecticut. All cigarette dealer’s

licenses must be renewed each year and expire on September 30 of each year.

(All other cigarette dealers or distributors must also complete REG-2-CIG.)

Are you engaged in the business of selling cigarettes at retail (other than through

vending machines) in Connecticut? ...............................................................................................

Yes

No

If you answered Yes to the cigarette dealer’s license question,

__ __ - __ __ - __ __

enter the date that you will start selling cigarettes: ......................................................................

m

m

d

d

y

y

Penalty for operating without a Cigarette Dealer’s License is $5 a day.

(See Section 18 to calculate the penalty fees.)

Page 5 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6