Instructions For 1040 Ez Form - Internal Revenue Service - 2005 Page 37

ADVERTISEMENT

If an envelope addressed to “Internal Revenue

Internal Revenue Service Center shown

Where Do

Service Center” came with this booklet,

that applies to you. Envelopes without

You File?

please use it. If you do not have one or if you

enough postage will be returned to you by

moved during the year, mail your return to the

the post office.

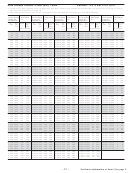

THEN use this address if you:

Are not enclosing a check or

Are enclosing a check or

IF you live in...

money order...

money order...

Alabama, Delaware, Florida, Georgia, North Carolina,

Internal Revenue Service Center

Internal Revenue Service Center

Rhode Island, South Carolina, Virginia

Atlanta, GA 39901-0014

Atlanta, GA 39901-0114

District of Columbia, Maine, Maryland, Massachusetts, Internal Revenue Service Center

Internal Revenue Service Center

New Hampshire, New York, Vermont

Andover, MA 05501-0014

Andover, MA 05501-0114

Connecticut, Illinois, Indiana, Iowa, Michigan,

Internal Revenue Service Center

Internal Revenue Service Center

Minnesota, Missouri, North Dakota, Ohio, Wisconsin

Kansas City, MO 64999-0014

Kansas City, MO 64999-0114

Internal Revenue Service Center

Internal Revenue Service Center

New Jersey, Pennsylvania

Philadelphia, PA 19255-0014

Philadelphia, PA 19255-0114

Arkansas, Kansas, Kentucky, Louisiana, Mississippi,

Internal Revenue Service Center

Internal Revenue Service Center

Oklahoma, Tennessee, Texas, West Virginia

Austin, TX 73301-0014

Austin, TX 73301-0114

Alaska, Arizona, California, Colorado, Hawaii, Idaho,

Internal Revenue Service Center

Internal Revenue Service Center

Montana, Nebraska, Nevada, New Mexico, Oregon,

Fresno, CA 93888-0014

Fresno, CA 93888-0114

South Dakota, Utah, Washington, Wyoming

American Samoa, nonpermanent residents of Guam or

Internal Revenue Service Center

Internal Revenue Service Center

the Virgin Islands*, Puerto Rico (or if excluding income

Philadelphia, PA 19255-0215

Philadelphia, PA 19255-0215

under Internal Revenue Code section 933), dual-status

USA

USA

aliens, and those filing Form 4563

Internal Revenue Service Center

Internal Revenue Service Center

All APO and FPO addresses, a foreign country: U.S.

Austin, TX 73301 – 0215

Austin, TX 73301 – 0215

citizens and those filing Form 2555 or 2555EZ

USA

USA

* Permanent residents of Guam should use: Department of Revenue and Taxation, Government of Guam, P.O. Box 23607, GMF, GU 96921;

permanent residents of the Virgin Islands should use: V.I. Bureau of Internal Revenue, 9601 Estate Thomas, Charlotte Amalie, St. Thomas, VI 00802.

What’s Inside?

(see Index for

IRS e-file and free file options

Help with unresolved tax issues

page numbers)

Commissioner’s message

Free tax help

When to file

How to get forms and publications

What’s new for 2005

Tax table

Index (page 34)

How to make a gift to reduce debt

How to comment on forms

held by the public

How to avoid common mistakes

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37