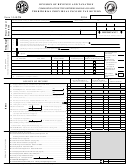

Form 1040cm - Territorial Individual Income Tax Return 2004 Page 3

ADVERTISEMENT

Form 1040CM (2004)

Page 3

A. YOURSELF

B. SPOUSE

(See instuctions on pages 78, 79, and 80)

1

CNMI wages and salaries from Form(s) W-2 and W-2CM........................................1

2

Other CNMI wages and salaries not included in line 1..........................................2

3

Total CNMI wages and salaries (add lines 1 and 2)...............................................3

4

Amount on line 3 not subject to the wage and salary tax (attach explanation)......4

5

CNMI wages and salaries (subtract line 4 from line 3)...........................................5

6

Annual wage and salary tax..................................................................................6

7

Education tax credit (attach Schedule ETC)..........................................................7

8

Wage and salary tax after credit (subtract line 7 from line 6)..................................8

9

Combined annual wage and salary tax (add line 8, columns A and B)...........................................................9

10 Wage and salary tax withheld and/or paid...................................................................................................10 (

)

11 Total wage and salary tax due or (overpaid) (add lines 9 and 10).............................................................

11

A. YOURSELF

B. SPOUSE

1

Gain from the sale of personal property.................................................................1

2

One half of the gain from the sale of real property.................................................2

3

One half of the net income from leasing of real property.........................................3

4

Interest, dividends, rents, royalties (see important instructions on page 79)..........4

5a Gross winnings from any gaming, lottery, raffle, etc............................................. 5 a

b Less amount excludable (attach Form(s) W-2G)....................................................5b (

)

(

)

c Balance (subtract line 5b from line 5a)................................................................5c

6

Other income subject to the NMTIT, unless excludable under the earnings tax...........6

7

Total income subject to the earnings tax (add lines 1 thru 4, line 5c, and line 6).......7

8

Annual earnings tax.............................................................................................. 8

9

Education tax credit (attach Schedule ETC)......................................................... 9

10 Earnings tax after credit (subtract line 9 from line 8)............................................10

11 Total earnings tax due. (add line 10, columns A and B).............................................................................

11

COMPLETE SCHEDULE OS-3405A (APPLICATION FOR REBATE ON CNMI SOURCE TAX) ON PAGE 4, BEFORE COMPLETING PART C

1

Chapter 7 tax underpayment after non-refundable credit (enter amount from Form OS-3405A, line 16, part B).........................1

2

Chapter 7 overpayment after non-refundable credit (enter amount from Form OS-3405A, line 15, part B).........................2 (

)

3

Rebate offset amount (enter amount from Form OS-3405A, line 17, part B)..................................................................3 (

)

4

Chapter 7 liability or (overpayment) after rebate offset amount (add lines 1 through 3) ................................................4

5

Tax on overpayment of credits......................................................................................................... . . . . . . . . . . . . . . . . . . 5

6

Estimated tax penalty..........................................................................................................................................6

7

Total Chapter 7 liability or (overpayment) (add lines 4, 5 and 6)...........................................................................

7

1

Amount due or (overpaid), Chapter 2 and Chapter 7 (add lines 11 of part A and B, and line 4 of part C).........1

2

CHAPTER 2

:

(b) Failure to File.................. ...............2b

(a)

(c) Failure to Pay.............................................2c

Enter amount underpaid

(d) Interest Charge............................................2d

3

CHAPTER 7

:

(b) Failure to File......................................... 3b

a)

(c) Failure to Pay. ...................................... 3c

Enter amount underpaid

d) Interest Charge..................................... 3d

4

Total penalty and interest charges (add lines 2b, 2c, 2d, 3b, 3c, and 3d).........................................................4

5

Total amount due or (overpaid), Chapter 2 and Chapter 7 (add lines 1 and 4 of this part, and lines 5 and 6 of part C).......5

If line 5 is an overpayment, enter amount you want credited to your 2005 ESTIMATED TAX........................... . 6

6

7

Amount from line 5 you want credited to your 2005 BUSINESS GROSS REVENUE TAX . ..............................................7

8

Net overpayment.............................................................................................................................................8

(

)

Do you want to allow another person to discuss this return with the Division of Revenue and Taxation (see page 56)?

Yes. Complete the following.

No.

Designee’s name

Phone no.

(

)

Personal identification number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

(

)

Spouse’s signature. If a joint return, BOTH must sign.

Date

Spouse’s occupation

Preparer’s

Date

Check if

Preparer’s SSN or PTIN

signature

self-employed

Firm’s name (or yours if self-

EIN

employed) and address and Zip

Phone no. (

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4