Form 1040cm - Territorial Individual Income Tax Return 2004 Page 4

ADVERTISEMENT

Form 1040CM(2004)

Page 4

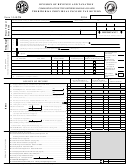

SCHEDULE OS-3405A (APPLICATION FOR REBATE ON CNMI SOURCE INCOME TAX)

AND CLAIM FOR ADDITIONAL CHILD TAX CREDIT

(See instructions on page 81)

PART A - Non-refundable Credits

1

Wage and salary tax............................................................................................................1

2

Earnings tax.........................................................................................................................2

3

Business gross revenue tax

Name

Tax ID No.

a)

a)

b)

b)

c)

c)

4

User fees paid.......................................................................................................................4

5 Fees and taxes imposed under 4CMC §2202(h)....................................................................5

6 Total non-refundable credits (add lines 1 through 5).........................................................................................................6

PART B - Rebate Computation

7

Allocable percentage:

a Tax without the CNMI

7a

%

b Tax within the CNMI

7b

%

8

Total NMTIT on all sources....................................................................................................8

9

Total NMTIT payments made ................................................................................................9

10 Tax on sources without CNMI (multiply line 8 by the percentage as shown on line 7a).................................................10

11 Tax on sources within the CNMI (multiply line 8 by the percentage as shown on line 7b)..11

12 Total non-refundable credits (enter amount from line 6, part A).........................................12

13 Adjusted CNMI source tax (subtract line 12 from line 11. If zero or less, enter -0).......................................................13

14 Total CNMI and NON-CNMI source tax after non-refundable credits (add lines 10 and 13)............................................14

15 NMTIT overpayment (subtract line 14 from line 9. If zero or less, enter -0-).................................................................15

16 Total tax underpaid (If line 14 is greater than line 9, subtract line 9 from line 14, otherwise, enter -0-).........................16

17 Rebate base computation. (Enter this amount on Page 3, Part C, line 3)........................................................................17

PART C - Additional Child Tax Credit Computation

Special Notice

This Part is provided to enable the Division of Revenue and Taxation to process your claim of the Additional Child Tax Credit (ACTC). Please note that

the ACTC is being paid by the U.S. Treasury, and the Division of Revenue and Taxation is only facilitating your ACTC claim as agreed upon between the

CNMI Department of Finance and the U.S. Treasury. By applying for the ACTCt Refund and allowing the refund to be processed by the Division of

Revenue and Taxation, you are giving the Division of Revenue and Taxation authorization to release tax information to the Internal Revenue Service (IRS).

See important instructions on page 82, Part C, line 2 regarding rebate offset.

1

Additional Child Tax Credit. Enter the amount from line 13 of Form 8812. (Attach Form 8812)...........................1

2

Enter the amount underpaid from line 5, Part D, page 3...............................................................................................2

3

Additional Child Tax Credit refund (line 1 minus line 2, but not less than zero).............................................................3

4

Amount you still owe on this return after offset of the ACTC (line 2 minus line 1, but not less than zero)....................4

PART D. Business Gross Revenue Tax Credit Allocation

Enter the TIN and amount you want credited from line 7, Part D, page 3. The total credit allocation shall be equal to the amount on line 7, page 3.

TIN

TAX TYPE

AMOUNT

TIN

TAX TYPE

AMOUNT

3105G

3105G

3105AF

3105AF

3105MW

3105MW

FOR OFFICIAL USE ONLY

DATE FILED *

DATE PAID

AMOUNT PAID

RECEIPT NO.

VERIFIED BY

POSTED BY

DEADLINE: APRIL 15, 2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4