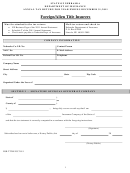

NAIC NUMBER:

COMPANY NAME:

Schedule B: Itemization of Life, Accident & Health Premiums and Tax Calculation (L.R.S. 22§842)

Annual Premium Computation. The annual premium referred to in this part shall be the gross amount of direct premiums, excluding premiums on

annuity contracts, for the preceding year, less return premiums without any deductions for dividends paid or otherwise credited to policyholders, and

§843

without consideration for reinsurance (L.R.S. 22

).

Premiums Written During 2011 – Total on Line D below must be equal to premium reported on the Annual Statement (A.S.) Schedule T

and State Page (Page 24) for Life, Accident & Health, or State Page [Page 19 - lines 13 through 15.8 & (a)] of Property and Casualty, or

Schedule T and Exhibit of Premiums, Enrollment and Utilization (Page 29) for Health/HMOs.

2011 A.S. Reference

PAGE/LINE NUMBER

Direct

P & C

L, A & H

Premiums

ACCIDENT & HEALTH and HMO

1.

Group

19/13

24/24

2.

Federal Employees Health Benefits Program

19/15.8

24/24.1

3.

Credit (Group and Individual)

19/14

24/24.2

4.

Collectively Renewable Policies

19/15.1

24/24.3

5.

Individual Non-Cancelable

19/15.2

24/25.1

6.

Individual Guaranteed Renewable

19/15.3

24/25.2

7.

Individual Non-renewable for stated reasons only

19/15.4

24/25.3

8.

Individual Other (accident only)

19/15.5

24/25.4

9.

Medicare Title XVIII (tax exempt)

19/15.6

24/24.4

10.

Individual All Other

19/15.7

24/25.5

11.

Finance and Service Charges

19/ (a)

(not included above)

LIFE INSURANCE

12.

Ordinary

24/1 Col 1

13.

Credit Life (Group and Individual)

24/1 Col 2

14.

Group

24/1 Col 3

15.

Industrial

24/1 Col 4

SERVICE INSURANCE

16.

Applies to domestic service insurers only

A

TOTAL GROSS PREMIUM

$

PREMIUM EXEMPTED FROM STATE TAX. Cite statute, court decision or other legal basis allowing the exemption. An invalid reason

will be taxed and may be penalized - See Note below. In the space provided below, identify the line number listed above, the reason

allowing the exemption, and the exempted premium amount.

Line # Reason for exempting premium:

Premium Amount

17. Total Exempted Premium

$

B

Total Net Taxable Premium (Line A - Line 17)

$

NOTE: Gross premium may be reduced if the requirements of Danna v. Commissioner of Insurance 228 So. 2d 708 are met for employer-insurer provided

group policies for employees. Also, Federal Employee Health Benefits premium are not taxable if the requirements of 5 U.S.C. §8909 are met.

Medicare Title XVIII premiums are also exempt.

Form 1061 (Revised 10-11)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER L.R.S. 44§4

Page 3 of 6

1

1 2

2 3

3 4

4 5

5 6

6