Income Tax Return Instructions - State Of South Carolina Page 14

ADVERTISEMENT

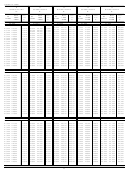

1999 Tax Table

If

If

If

If

If

taxable income

taxable income

taxable income

taxable income

taxable income

is:

is:

is:

is:

is:

BUT

Your

BUT

Your

BUT

Your

BUT

Your

BUT

Your

AT

AT

AT

AT

AT

LESS

Tax

LESS

Tax

LESS

Tax

LESS

Tax

LESS

Tax

LEAST

LEAST

LEAST

LEAST

LEAST

THAN

Is:

THAN

Is:

THAN

Is:

THAN

Is:

THAN

Is:

83,000

87,000

91,000

95,000

99,000

99,000

99,100

$6,595

83,000

83,100

$5,475

87,000 87,100

$5,755

91,000 91,100

$6,035

95,000 95,100

$6,315

95,100 95,200

$6,322

99,100

99,200

$6,602

83,100

83,200

$5,482

87,100 87,200

$5,762

91,100 91,200

$6,042

95,200 95,300

$6,329

99,200

99,300

$6,609

83,200

83,300

$5,489

87,200 87,300

$5,769

91,200 91,300

$6,049

91,300 91,400

$6,056

95,300 95,400

$6,336

99,300

99,400

$6,616

83,300

83,400

$5,496

87,300 87,400

$5,776

87,400 87,500

$5,783

91,400 91,500

$6,063

95,400 95,500

$6,343

99,400

99,500

$6,623

83,400

83,500

$5,503

83,500

83,600

$5,510

87,500 87,600

$5,790

91,500 91,600

$6,070

95,500 95,600

$6,350

99,500

99,600

$6,630

83,600

83,700

$5,517

87,600 87,700

$5,797

91,600 91,700

$6,077

95,600 95,700

$6,357

99,600

99,700

$6,637

99,700

99,800

$6,644

83,700

83,800

$5,524

87,700 87,800

$5,804

91,700 91,800

$6,084

95,700 95,800

$6,364

95,800 95,900

$6,371

99,800

99,900

$6,651

83,800

83,900

$5,531

87,800 87,900

$5,811

91,800 91,900

$6,091

95,900 96,000

$6,378

99,900 100,000

$6,658

83,900

84,000

$5,538

87,900 88,000

$5,818

91,900 92,000

$6,098

92,000 92,100

$6,105

96,000 96,100

$6,385

84,000

84,100

$5,545

88,000 88,100

$5,825

88,100 88,200

$5,832

92,100 92,200

$6,112

96,100 96,200

$6,392

84,100

84,200

$5,552

84,200

84,300

$5,559

88,200 88,300

$5,839

92,200 92,300

$6,119

96,200 96,300

$6,399

$100,000 or over

84,300

84,400

$5,566

88,300 88,400

$5,846

92,300 92,400

$6,126

96,300 96,400

$6,406

-use tax rate

84,400

84,500

$5,573

88,400 88,500

$5,853

92,400 92,500

$6,133

96,400 96,500

$6,413

schedule below

96,500 96,600

$6,420

84,500

84,600

$5,580

88,500 88,600

$5,860

92,500 92,600

$6,140

96,600 96,700

$6,427

84,600

84,700

$5,587

88,600 88,700

$5,867

92,600 92,700

$6,147

92,700 92,800

$6,154

96,700 96,800

$6,434

84,700

84,800

$5,594

88,700 88,800

$5,874

88,800 88,900

$5,881

92,800 92,900

$6,161

96,800 96,900

$6,441

84,800

84,900

$5,601

84,900

85,000

$5,608

88,900 89,000

$5,888

92,900 93,000

$6,168

96,900 97,000

$6,448

85,000

89,000

93,000

97,000

93,000 93,100

$6,175

97,000 97,100

$6,455

85,000

85,100

$5,615

89,000 89,100

$5,895

89,100 89,200

$5,902

93,100 93,200

$6,182

97,100 97,200

$6,462

85,100

85,200

$5,622

85,200

85,300

$5,629

89,200 89,300

$5,909

93,200 93,300

$6,189

97,200 97,300

$6,469

85,300

85,400

$5,636

89,300 89,400

$5,916

93,300 93,400

$6,196

97,300 97,400

$6,476

85,400

85,500

$5,643

89,400 89,500

$5,923

93,400 93,500

$6,203

97,400 97,500

$6,483

85,500

85,600

$5,650

89,500 89,600

$5,930

93,500 93,600

$6,210

97,500 97,600

$6,490

97,600 97,700

$6,497

85,600

85,700

$5,657

89,600 89,700

$5,937

93,600 93,700

$6,217

93,700 93,800

$6,224

97,700 97,800

$6,504

85,700

85,800

$5,664

89,700 89,800

$5,944

89,800 89,900

$5,951

93,800 93,900

$6,231

97,800 97,900

$6,511

85,800

85,900

$5,671

85,900

86,000

$5,678

89,900 90,000

$5,958

93,900 94,000

$6,238

97,900 98,000

$6,518

86,000

86,100

$5,685

90,000 90,100

$5,965

94,000 94,100

$6,245

98,000 98,100

$6,525

86,100

86,200

$5,692

90,100 90,200

$5,972

94,100 94,200

$6,252

98,100 98,200

$6,532

86,200

86,300

$5,699

90,200 90,300

$5,979

94,200 94,300

$6,259

98,200 98,300

$6,539

98,300 98,400

$6,546

86,300

86,400

$5,706

90,300 90,400

$5,986

94,300 94,400

$6,266

94,400 94,500

$6,273

98,400 98,500

$6,553

86,400

86,500

$5,713

90,400 90,500

$5,993

90,500 90,600

$6,000

94,500 94,600

$6,280

98,500 98,600

$6,560

86,500

86,600

$5,720

86,600

86,700

$5,727

90,600 90,700

$6,007

94,600 94,700

$6,287

98,600 98,700

$6,567

86,700

86,800

$5,734

90,700 90,800

$6,014

94,700 94,800

$6,294

98,700 98,800

$6,574

86,800

86,900

$5,741

90,800 90,900

$6,021

94,800 94,900

$6,301

98,800 98,900

$6,581

86,900

87,000

$5,748

90,900 91,000

$6,028

94,900 95,000

$6,308

98,900 99,000

$6,588

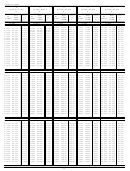

1999 Tax Rate Schedule for taxable income over $100,000.

Caution: You must use the Tax Tables instead of this Tax Rate Schedule if your taxable income is less than $100,000.

Example of Tax Rate Schedule Computation

Use this rate schedule regardless of the filing

status you checked on Form SC1040.

If South Carolina income subject to tax on SC1040 line 6, or

SC1040NR line 1 is $101,000 the tax is calculated as follows:

If the amount on SC1040 line 6, or SC1040NR line 1 is $100,000

or more:

$101,000.00

income from SC1040 line 6 or SC1040NR line 1

X .07

(.07)

Compute your tax as follows and enter the results on Form

7,070.00

- 339.00

subtraction amount (constant)

SC1040 line 7, or SC1040NR line 2:

$

6,731.00

tax

7% times the amount on SC1040 line 6, or SC1040NR line 1

$6,731.00 is the amount of Tax to be entered on SC1040 line 7, or

minus $339.

SC1040NR, line 2 in this example.

27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14