Income Tax Return Instructions - State Of South Carolina Page 4

ADVERTISEMENT

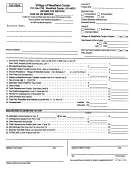

3. Divide the amount on line 1

expenses is 7 percent of the federal expense. Your South

Worksheet B by the amount on

Carolina credit is computed by multiplying the federal child

line 2 worksheet B and enter the

care expense on federal Form 2441, line 6, or 1040A

%

result here.

3. ____________

Schedule 2, Part II, line 6 by .07. Married filing

separately cannot claim this credit.

4. Enter the amount from line 9 of the

itemized deductions worksheet in

Example: If your federal child care expense entered on

the instruction booklet for federal

Form 2441, line 6 or 1040A, Schedule 2, Part II,

Form 1040.

4. ____________

line 6 is $2,000, your computation should be:

5. Multiply the amount on line 4 above

$2,000 X .07 = $140

by the percentage on line 3 above

and enter the results here.

5. ____________

In this example, the allowable tax credit for

dependent care expense would be $140.00.

6. Subtract the amount on line 5 above

from the amount on line 1 above.

Line 11 TWO WAGE EARNER CREDIT (MARRIED

Enter this amount here and on line 4

COUPLE)

of worksheet A above.

6. ____________

Complete Schedule W on the back of South Carolina Form

SC1040 if you can take the two wage earner credit. You

Line 2b STATE TAX REFUND

may take the credit if both you and your spouse:

South Carolina does not tax state tax refunds. If your state

work and have qualified earned income and

tax refund was included on line 10 of your federal return,

that amount should be entered on line 2b.

file a joint return.

Line 5 OTHER ADJUSTMENTS, IF APPLICABLE

There are three steps to follow in computing the credit.

For other adjustments to income see instructions for line

35-53, pages 11 - 15. If applicable, make your entries on

Step 1 (lines 1, 2 and 3). Compute earned income

these lines and enter net adjustments from line 55 as a

separately for yourself and your spouse. This is generally

positive (plus) or negative (minus) amount.

income you receive for services you provide. It includes

Line 6 SOUTH CAROLINA INCOME SUBJECT TO TAX

wages, salaries, tips, commissions, sub-pay, etc. (from

If the amount on line 5 is a negative (minus) figure,

federal Form 1040, line 7, Form 1040A, line 7 or Form

subtract it from the amount on line 4 and enter the

1040EZ, line 1). It also includes income earned from

difference on line 6. If the amount on line 5 is a positive

self-employment (from Schedules C and F of federal Form

(plus) figure, add the amounts on lines 4 and 5 and enter

1040 and Schedule K-1 of federal Form 1065) and net

the sum on line 6.

earnings and gains (other than capital gains) from

disposition, transfer or licensing property that you created.

SOUTH CAROLINA TAX

Earned income does not include interest, dividends, Social

Line 7 TAX

Security

benefits,

IRA

distribution,

unemployment

If your "income subject to tax" on line 6 is less than

compensation, deferred compensation nor non-taxable

$100,000 use the tax tables on pages 24 through 27 to

income. It also does not include any amount your

determine your South Carolina tax and enter the amount of

spouse paid you.

tax on line 7.

Step 2 (lines 4 and 5). Compute qualified earned income

If your "income subject to tax" on line 6 is $100,000 or

separately for yourself and your spouse by subtracting

more, use tax rate schedule on page 27 to compute your

certain adjustments from earned income. These

tax and enter the amount of tax on line 7.

adjustments (and the related lines on Federal Form 1040)

are:

Line 8 TAX ON LUMP SUM DISTRIBUTION

South Carolina provisions for lump sum distributions are

Disability income included on 1040, line 7, or 1040A,

the same as the federal provisions except South Carolina

line 7, if you have subtracted this amount on line 42 of

does not impose a premature distribution penalty.

Form SC1040

IRA deduction (from line 23, 1040, or line 15, 1040A)

If you used federal Form 4972 for a lump sum distribution,

self-employment tax (from line 27)

you must use the South Carolina Form SC4972 to compute

the South Carolina tax.

self-employed health insurance deduction (from line 28)

Keogh retirement plan and self-employed SEP

CREDITS

deduction (from line 29)

Line 10 CHILD AND DEPENDENT CARE

repayment of unemployment benefits or employee

The South Carolina credit for child and dependent care

business expenses included in the total on line 32.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

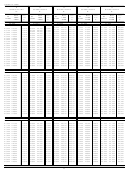

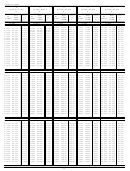

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14