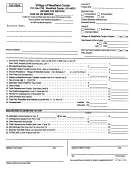

Income Tax Return Instructions - State Of South Carolina Page 5

ADVERTISEMENT

Enter the total of any adjustments that apply to you or your

Line 20 COLLEGE TUITION TAX CREDIT

A refundable credit may be claimed by a student or by an

spouse's earned income in the appropriate column of line

individual eligible to claim the student as a dependent on

4.

his/her federal income tax return, whoever actually paid

the college tuition.

Step 3 (lines 6, 7, and 8). Compute the credit based on

the smaller of:

You must file form SC1040 to claim this credit.

the qualified earned income entered in column (a) or (b)

To see if you qualify for this credit, see form I-319 for

of line 5, whichever is less OR

further details. You must complete form I-319 and attach

$30,000.

it to your return. Complete a separate form I-319 for each

qualifying student and attach a copy of your federal return.

Example - You earned a salary of $20,000 and had an IRA

deduction of $2,000. Your spouse earned $17,000 and had

REFUND OR AMOUNT YOU OWE

an IRA deduction of $1,000. Your qualified earned income

Line 24 ESTIMATED TAX

is $18,000 ($20,000 minus $2,000) and your spouse's is

If you want to apply any or all of your refund toward next

$16,000 ($17,000 minus $1,000). Because your spouse's

year's tax, enter the amount on line 24.

qualified earned income is less than yours, the credit is

based on your spouse's income. Therefore, the credit is

Line 25 - 31

$112 ($16,000 x .007).

See page 16 for specific information about the various

funds to which you may contribute.

Line 12 OTHER NON-REFUNDABLE CREDITS

See back of Schedule W-NR for an explanation of the

Line 33 REFUND TO YOU

other non-refundable credits.

If you have an amount on line 32, subtract line 32 from line

TAX PAYMENTS/CREDITS

22 and enter the "Amount to be Refunded to You" on line

33, otherwise, enter the amount from line 22. The SC

Line 15 SC INCOME TAX WITHHELD FROM WAGES

Department of Revenue will not refund amounts less than

Enter the total SC tax withheld from your wages. The SC

$1.00.

tax is the amount on your wage slips (Form W-2, Box 18)

titled "State Income Tax."

Line 34 AMOUNT YOU OWE

If you have an amount on line 32, add lines 32 and 23 and

If you have South Carolina withholding from any federal

enter the "Amount You Owe" on line 34; otherwise, enter

form 1099, include that amount on line 19.

the amount from line 23. Attach a check or money order

to your return and write your Social Security number

Attach READABLE copies of your wage slips to the front of

and "1999 Form SC1040" on it. Make it payable to the

your return. You must provide proof of any tax withheld

"SC Department of Revenue." Note the SC2210 penalty

from your wages if you do not have a W-2 form. Copies of

below.

your wage slips are available only from your employer.

UNDERPAYMENT OF ESTIMATED TAX - SC2210

You may owe a penalty for underpayment if you did not

Line 16 1999 ESTIMATED TAX PAYMENTS

pay at least the smaller of: 90 percent of your tax liability

Enter the total estimated tax payments you made before

for 1999; or 100 percent of your tax liability for 1998.

filing your 1999 South Carolina tax return plus any amount

However, if your adjusted gross income is $150,000 or

transferred from your 1998 tax return.

more, the 100% rule is modified to be 105% of the tax

shown on your 1998 income tax return. Use SC2210 to

Line 17 PAYMENTS ON EXTENSION

determine any penalty that may be due. If you are due a

If you requested an extension for more time to file your

refund, subtract the penalty amount from the difference of

return, enter on line 17 any amount you paid with the

line 22 and line 32 and enter the result on line 33. If you

extension.

owe tax, add the penalty amount to the sum of the amount

due on line 23 and line 32 and enter the result on line 34.

Line 18 NONRESIDENT SALE OF REAL ESTATE

A nonresident of South Carolina who sells real property

SIGNATURES OF TAXPAYER(S) AND TAX PREPARER

You must sign and date your return. If married and filing a

located in this state is subject to withholding of South

joint return, both spouses must sign in the spaces

Carolina income taxes. Such sale must be reported to

provided.

South Carolina on an individual income tax return. If state

income taxes were withheld at the time of sale, claim the

POWER OF ATTORNEY

amount withheld on line 18.

The signature section of the return contains a "check the

box" authorization for release of confidential information. A

Line 19 SC INCOME TAX WITHHELD - FORM 1099

check in the "yes" box authorizes the Director of the

Enter the total SC tax withheld from Form 1099 and attach

Department of Revenue or delegate to discuss the return,

a copy of Form 1099 to the front of your return. Form W-2

its

attachments

and

any

notices,

adjustments

or

withholding should be entered on line 15.

assessments with the preparer.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14