Income Tax Return Instructions - State Of South Carolina Page 8

ADVERTISEMENT

the SC1040. The retirement deduction does not apply to

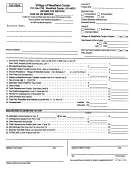

Line 45 AGE 65 AND OLDER DEDUCTION

these types of retirement income since no amount is taxed

A resident individual who before or during 1999 has

attained the age of sixty-five is allowed a maximum

by South Carolina.

deduction of $15,000 against any SC taxable income.

EXAMPLE #1: Mr. Brown is 67 years old, and Mrs. Brown

is 63 years old. In 1999, Mr. Brown has the following

qualified retirement income: IRA $3,500; XYZ CORP,

The $15,000 deduction is reduced by any retirement

$5,500. Also, Mrs. Brown has the following qualified

deduction claimed by the taxpayer who is age 65 or

retirement income: ABC Corp. $12,000.

older.

On line 44a of the SC1040, Mr. Brown, already over age

Retirement income deduction amounts deducted as a

65, enters his date of birth and will be limited to $9,000

surviving

spouse

do

not

reduce

this

$15,000

($3,500 + $5,500) of the $10,000 annual deduction.

deduction.

Amount to enter on line 44a of SC1040 is $9,000.

On line 44b of the SC1040, Mrs. Brown age 63, will be

Taxpayers filing a joint return are allowed a deduction

limited to a $3,000 retirement deduction.

of up to $15,000 when only one spouse is 65 or older

and up to $30,000 when both spouses are 65 or older

EXAMPLE #2: Same facts as in Example #1 except Mr.

by the end of the tax year.

Brown has additional qualified retirement income from B &

C Corp. for $15,500.

Complete the appropriate worksheet below based on

On line 44a of the SC1040, Mr. Brown will enter the full

your filing status.

$10,000 annual retirement deduction since his qualified

retirement totals $24,500.

Worksheet A: Single, Married filing jointly with one

taxpayer a resident and age 65 or older, Married filing

Worksheet for line 44a: TAXPAYER/SURVIVING

separately, Head of household, or Widow(er) with

SPOUSE

dependent child

If you are a surviving spouse, check box. Enter the

1. Maximum deduction allowed

$15,000.00

taxpayer's and/or surviving spouse's taxable portion of

qualified retirement income that may be included on the

2. Enter the total amount of retirement

federal tax return. (DO NOT include the taxable portion of

deduction claimed on line 44a or 44b

Social Security, Railroad retirement, and/or disability

for the taxpayer who is age 65 or older.

income shown on your federal tax return. See instructions

(Do not include surviving spouse

for lines 42 & 43).

amounts)

______________

Enter amount from federal 1040, line 15b

or 1040A, line 10b

____________ A

3. Subtract line 2 from line 1 and

Enter amount from federal 1040, line 16b

enter the amount here and on

or 1040A, line 11b

____________ B

SC1040, line 45a or 45b whichever

Add lines A and B.

____________ C

is applicable. Do not enter an

Maximum deduction allowed based on

____________ D

amount less than zero.

______________

age ($3,000 or $10,000)

Enter lesser of line C or D here and on

____________ E

line 44a of SC1040.

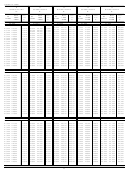

Worksheet B: Married filing jointly with both resident

taxpayers age 65 or older

Worksheet for line 44b: SPOUSE/SURVIVING SPOUSE

Taxpayer = First name shown on the return

Spouse = Second name shown on the return

If you are a surviving spouse, check box. Enter the

spouse's and/or surviving spouse's taxable portion of

Taxpayer(lines 1-3):

qualified retirement income that may be included on the

1. Maximum deduction allowed

$15,000.00

federal tax return. (DO NOT include the taxable portion of

Social Security, Railroad retirement, and/or disability

income shown on your federal tax return. See instructions

2. Enter the amount of retirement

for lines 42 & 43).

deduction claimed on line 44a

for Taxpayer. (Do not include

Enter amount from federal 1040, line 15b

surviving spouse amounts)

______________

or 1040A, line 10b

____________ A

Enter amount from federal 1040, line 16b

3. Subtract line 2 from line 1 and

or 1040A, line 11b

____________ B

enter the amount here and on

Add lines A and B.

____________ C

SC1040, line 45a. Do not enter

Maximum deduction allowed based on

____________ D

an amount less than zero.

______________

age ($3,000 or $10,000)

Enter lesser of line C or D here and on

____________ E

Spouse(lines 4-6):

line 44b of SC1040.

4. Maximum deduction allowed

$15,000.00

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14