Income Tax Return Instructions - State Of South Carolina Page 3

ADVERTISEMENT

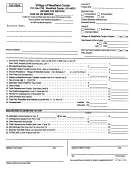

SC1040 (LONG FORM) INSTRUCTIONS 1999

COMPLETE YOUR FEDERAL RETURN BEFORE YOU BEGIN YOUR SOUTH CAROLINA TAX RETURN. YOUR COMPLETED FEDERAL RETURN

WILL CONTAIN INFORMATION WHICH YOU MUST ENTER ON THE SOUTH CAROLINA RETURN.

IF YOU WERE REQUIRED TO USE FEDERAL SCHEDULES C, D, E AND/OR F WITH YOUR FEDERAL RETURN, ATTACH A COPY OF YOUR

COMPLETED FEDERAL RETURN AND SCHEDULE(S) TO YOUR SOUTH CAROLINA RETURN BEFORE FILING IT.

NAME, ADDRESS AND SOCIAL SECURITY NUMBER

If you are claiming a deduction for children under six, you

must enter in the space provided the number of children

Use the preaddressed label from the back cover of this

under six. Also, be sure to complete the information

booklet only if all information is correct. If any information

required on line 51.

is incorrect, please discard label. If you did not receive a

preaddressed label or if it was incorrect, print or type your

Line 2a STATE INCOME TAXES, IF ITEMIZING ON

name, address, Social Security number and the code of

FEDERAL RETURN

the county in which you live. For a list of county codes see

If you deducted state and local income taxes while

page 31.

itemizing on your 1999 federal income tax return, you are

If you are married and filing a joint return, fill in your

required to add all or part of this amount to federal taxable

spouse's name and your spouse's Social Security number.

income to arrive at your South Carolina taxable income.

Use the worksheet below to figure the adjustment:

If you are married and filing separate returns, do not fill in

your spouse's Social Security number. Do not put your

State Income Tax Adjustment (Worksheet A)

spouse's name in this section. Fill in your spouse's

(Keep for your records.)

Social Security number next to your filing status, box

number 3.

1. Enter total itemized deductions from

federal Schedule A, line 28.

1. _____________

In compliance with the Federal Privacy Act of 1974, Public

Law 93-579, the disclosure of the individual's social

2. Enter allowable federal standard

security number on this form is mandatory. 42 U.S.C.

deduction you would have been

405(c)(2)(C)(I) allows a State (or a political subdivision

allowed if you had not itemized.

hereof) to utilize an individual's social security number in

(Enter zero if married filing

separate returns -- See federal

connection with the administration of any tax and SC

regulation 117-1 provides that any person required to

instructions)

2. _____________

make a return, statement or document to the Department

3. Subtract line 2 from line 1.

3. _____________

of Revenue must include identifying numbers on such

(Enter zero if line 2 is greater than line 1)

return, statement or document if the Department request

4. Enter the amount of state income

such information. Social security numbers are primarily

used for the purposes of identifying taxpayers and

taxes from line 5 of Schedule A,

monitoring tax compliance and/or fraud.

1040 or line 6 of Worksheet B if

your federal itemized deductions

NOTE:

NEXT YEAR DO YOU REALLY NEED A

were limited due to A.G.I. of more

BOOKLET?

than $126,600 ($63,300 MFS).

4. _____________

The block just below the city, state, and zip code line

should be checked if you use a tax preparer to complete

5. State income tax adjustment.

your return or for some other reason do not need a tax

Compare the amounts on lines 3

booklet next year. Most tax preparers have a supply of the

and 4 above, and enter the smaller

needed forms and do not need tax booklets. If you check

of the two amounts here and on form

this block, next year you will receive a pre-addressed label

SC1040, line 2a.

5. _____________

only. This is a savings of your tax dollars for printing and

postage.

State Income Tax Adjustment (Worksheet B)

Complete when federal adjusted gross income is more

than $126,600 ($63,300 MFS) and federal itemized

INFORMATION FROM FEDERAL RETURN

deductions are limited.

FILING STATUS

1. Enter the amount of state income

You must check the same filing status you checked on

taxes from line 5 of schedule A,

your federal return. Check only one box.

1040.

1. _____________

EXEMPTIONS

2. Enter the amount from line 3 of the

You must enter the same number of exemptions claimed

itemized deductions worksheet in the

on your federal return. Attach federal Form 8332,

instruction booklet for federal Form

Dependency Exemption for Child of Non-Custodial Parent,

1040.

2. _____________

if you are required to file this form with your federal return.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14