Income Tax Return Instructions - State Of South Carolina Page 9

ADVERTISEMENT

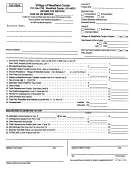

5. Enter the amount of retirement

SC Net LT Capital Gain (2 years) $7,000

(10,000 gain-3,000 loss)

deduction claimed on line 44b

- SC Net ST Capital Loss

- 5,000

(less than two years)

for Spouse. (Do not include surviving

SC Net Capital Gain

$2,000

spouse amounts)

______________

X Net LT Capital Gain Deduction

X 44%

Amount to be deducted on line 48

$880.00

6. Subtract line 5 from line 4 and

enter the amount here and on

Line 49 SUBSISTENCE ALLOWANCE

SC1040, line 45b. Do not enter

Subsistence allowances of $5 per regular workday are

an amount less than zero.

______________

allowed for police and all commissioned law enforcement

officers paid by South Carolina municipal, county, state

Line 46 OUT-OF-STATE RENTAL/BUSINESS OR REAL

governments

or

the

federal

government,

full-time

ESTATE INCOME NOT TAXABLE TO SOUTH CAROLINA

firefighters and full-time emergency medical service

If you have reported income from out-of-state rental

personnel.

property; a business located outside South Carolina; or

gain from real property located out of state, enter this

Line 50 QUALIFYING VOLUNTEER FIREFIGHTERS/

amount on line 46. However, personal service income

RESCUE SQUAD MEMBERS DEDUCTION

(W-2 or business wages) is taxable to South Carolina

Volunteer Firefighters and Rescue Squad Members are

no matter where it is earned.

allowed a $300 deduction to his or her SC taxable income

for the year ending December 31, 1999. The deduction will

Line 47 NEGATIVE FEDERAL TAXABLE INCOME

be increased to $3,000 for the year ending December 31,

Sometimes a taxpayer may end up with negative taxable

2000. Only those volunteer firefighters or rescue squad

income on the federal return. For example, if the

members receiving annually a minimum number of points

deductions and personal exemptions exceed the income or

as set by the state Fire Marshal are eligible for the

if there is a business loss that exceeds the other income

deduction. If you qualify, enter $300 on line 50.

on the return, a negative taxable income would result.

Line 51 DEPENDENTS UNDER SIX YEARS OF AGE

For the SC1040 form, it is important that a negative

An additional deduction is allowed for each dependent

number not be entered on line 1. Because the South

claimed on the federal income tax return who had not

Carolina return begins with federal taxable income, it is

reached the age of six years by December 31, 1999. Use

important that you get the benefit of the negative amount

the following worksheet to compute the deduction:

from the federal taxable income line of the federal return.

On the SC1040 form, start with zero on line 1 and put the

1999 Federal Personal Exemption Amount......

2,750

negative amount from the federal taxable income line of

Number of dependents claimed on your

the federal return on line 47 of SC1040.

1999 federal return who had not

reached age six during 1999 ............... x__________

Sometimes if all the income is eliminated on the federal

return before you get to the federal taxable income line,

Allowable deduction, enter this amount on

zeroes are entered instead of the negative amount. When

line 51 ..........................................................

__________

preparing the South Carolina return, however, it is

important to do the subtraction on the federal return all the

Line

52

ADDITIONAL

SELF-EMPLOYED

HEALTH

way down to the federal taxable income line. The negative

INSURANCE DEDUCTION

federal taxable income is entered on line 47 of SC1040.

A deduction is allowed for the portion of premiums paid for

self-employed

health

insurance

and

not

deducted

Line 48 NET CAPITAL GAIN DEDUCTION

pursuant to Internal Revenue Code 162(L).

Net capital gains which have been held for a period of two

or more years and have been included in the SC taxable

Line 53 OTHER SUBTRACTIONS FROM INCOME

income are reduced by 44% for SC income tax purposes.

Since these subtractions apply only to a few people, they

The term "net capital gain" means the excess of the net

are not fully explained in this booklet. Attach an

long-term capital gain for the taxable year over the net

explanation of your entry on this line. Some of the items

short-term capital loss for such year. Income received

which may be subtracted on line 53 are:

from installment sales as well as capital gain distribution

A deduction is allowed to an individual for the purchase

qualifies for this deduction provided the two or more

of economic impact zone stock. The deduction is equal

years holding period has been met. Multiply the net gain

to twenty percent of the total amount paid in cash by the

which meets the above guidelines by 44 percent (.44) and

taxpayer during the taxable year for the purchase of

enter the results on line 48 of SC1040.

economic impact zone stock.

Example: Taxpayer's gain on stock (held since 1980) is

If you itemized and claimed a federal tax credit for

$10,000. Also reported is a short term (ST) loss on stock

qualified mortgage credit certificates (MCC), you may

held for six months of $5,000 and a long term (LT) loss on

subtract the amount of the tax credit as interest on line

stock held since 1985 which amounts to $3,000.

53 of SC1040.

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14