Income Tax Return Instructions - State Of South Carolina Page 6

ADVERTISEMENT

If a person is paid to prepare the income tax return, their

Capital loss carryover incurred in a tax year prior to

signature and federal identification number are required in

January 1, 1985.

the spaces provided. Penalties are applicable for failure to

Federal net operating loss when claiming a different

comply.

amount for state purposes for losses prior to January 1,

1985, is an addition. In no event is the same loss to

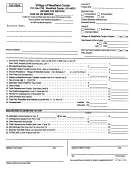

ADDITIONS TO FEDERAL TAXABLE INCOME

be deducted more than once. No carryback losses are

allowed.

Enter all numbers on line 35 through 38 as positive

numbers even if they are negative numbers on the federal

Expenses deducted on the federal return related to any

return.

income exempt or not taxed by South Carolina is an

addition. Some examples are investment interest to

Lines 35 through 38 are adjustments which must be

out-of-state partnerships and interest paid to purchase

added to your federal taxable income to determine your

United States obligations.

South Carolina taxable income. Line 39 is the total of

these additions.

Foreign areas allowances, cost of living allowances

and/or income from possessions of the United States

Line 35 OUT-OF-STATE LOSSES

are additions to federal taxable income.

If you have reported losses from out-of-state rental

Annuity costs recovered in full for state purposes, prior

property, a business located outside South Carolina, or

to January 1, 1985, are additions to federal taxable

losses from real property located out of state, enter this

income if using the federal ratio for cost recovery.

amount on line 35. You must also include any related

expenses, such as investment interest. Enter the total of

Miscellaneous federal estate tax deductions on income

these losses and related expenses on line 35.

in respect of decedent are additions.

Personal service income (W-2 or business wages) is

taxable to South Carolina no matter where it is earned.

Effective for qualifying investments made after June 30,

1998, taxpayers must reduce the basis of the qualifying

Line 36 EXPENSES RELATED TO RESERVE INCOME

property to the extent the Economic Impact Zone

If you reported military reserve income on your federal

Investment Tax Credit is claimed. An addition to federal

return, you must add the expenses related to this income.

taxable income must be made for the resulting reduction

If you itemized under the miscellaneous deduction subject

in depreciation.

to two percent, prorate the adjustment based on the ratio

of related expense to total expenses claimed, multiplied by

Depending upon how a particular item was reported or

the allowable deduction from federal Form 1040, Schedule

deducted, the following items may be an addition or a

A, line 26. Enter the amount of related expenses on line

subtraction:

36.

A change in the accounting method to conform in the

Line 37 INTEREST INCOME

same manner and the same amount to the federal. This

Interest income on obligations of states and political

may be an addition or a subtraction. At the end of the

subdivisions other than South Carolina must be added.

federal adjustment, any balance will continue until fully

Exempt interest income from a mutual fund is excludable

adjusted.

by the percentage the fund's assets consist of South

Carolina and/or federal obligations. Enter the amount of

The installment method of reporting is to be adjusted if

taxable interest income on line 37.

the entire sale has been reported for state purposes or

to continue on an installment basis if the entire sale has

Line 38 OTHER ADDITIONS TO INCOME

been reported for federal purposes. This may be an

Since these additions apply to only a few people, they are

addition or a subtraction.

not fully explained in this booklet. Attach an explanation of

your entry for this line. Some of the items which must be

Adjust the federal gain or loss to reflect any difference

added on this line are:

in the South Carolina basis and federal basis due to a

difference in laws prior to January 1, 1985. This may

Taxpayers that claim a child care program credit for

be an addition or a subtraction.

donations to a nonprofit corporation (Sch. TC-9) are not

allowed a deduction for those donations. The disallowed

For further information contact your nearest Taxpayer

deductions are an addition to federal taxable income.

Service Center. (See the back cover of this booklet.)

Taxpayers that claim a credit for wages paid to

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

employees terminated due to a base closure (Sch.

TC-10) must reduce the deduction for wages paid by the

Enter all numbers on line 40 through 53 as positive

amount of the credit. The amount of this credit is an

numbers even if they are negative numbers on the federal

addition to federal taxable income.

return.

11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14