Legal Business Name (as shown on page 1)

FEIN or SSN

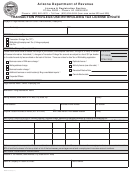

SECTION D: Rental Properties

List the addresses for ALL rental properties located in the cities listed in Section C. If you need more space, attach Additional Owner, Partner, Corporate

Officer(s) form available at Residential rental properties rented for periods of less than 30 days are taxable under the Transient Lodging

classification and not taxable under the Residential Rental classification according to the Model City Tax Code and are taxed at a different rate. Do not

use this form for properties classified as Transient Lodging.

STREET ADDRESS

CITY

ZIP CODE

DATE ACQUIRED

M M Y Y Y Y

1

M M Y Y Y Y

2

M M Y Y Y Y

3

M M Y Y Y Y

4

M M Y Y Y Y

5

M M Y Y Y Y

6

M M Y Y Y Y

7

M M Y Y Y Y

8

M M Y Y Y Y

9

M M Y Y Y Y

10

SECTION E: AZTaxes.gov Security Administrator (authorized users)

By electing to register for , you can have online access to account information, file and pay Arizona transaction privilege, use, and

withholding taxes. You may also designate authorized users to access these services. Please provide the name of the authorized user for AZTaxes.gov.

Name of Authorized User

Title

Email Address

Phone Number (with area code)

SECTION F: Required Signatures

This application must be signed by either a sole owner, at least two partners, managing member or corporate officer legally responsible for the business,

trustee or receiver or representative of an estate that has been listed in Section B.

Under penalty of perjury I (we), the applicant, declare that the information provided on this application is true and correct. I (we) hereby

authorize the security administrator, if one is listed in Section E, to access the AZTaxes.gov site for the business identified in Section A. This authority

is to remain in full force and effective until the Arizona Department of Revenue has received written termination notification from an authorized officer.

1 Print or Type Name

2 Print or Type Name

Title

Title

Date

Date

Signature

Signature

This application must be completed, signed, and returned as provided by A.R.S. § 23-722.

Equal Opportunity Employer/Program

Print Form

ADOR 11186 (5/16)

TRANSACTION PRIVILEGE TAX CITY ONLY APPLICATION

Page 3 of 3

1

1 2

2 3

3 4

4 5

5