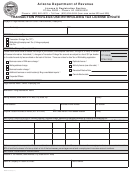

CITY ONLY APPLICATION

INSTRUCTIONS

Section A: BUSINESS INFORMATION

Section C: CITY LICENSE FEE WORKSHEET

1. Type of Ownership:

Check as applicable.

A

To calculate the city license fees, use the listing of cities on

corporation must provide the state and date of

page 2 of this application. City fees are subject to change.

incorporation.

Check for updates at

AA: TOTAL City Fees DUE– To calculate the city fee,

2. Provide the Legal Business Name or owner or

multiply No. of Locations by the license fee and enter

corporation as listed in its articles of incorporation,

sum in Subtotal City License Fees. Then calculate

or individual and spouse, or partners, or organization

and enter the sum of columns 1 + 2 + 3.

owning or controlling the business.

3. Provide your Federal Employer Identification No.

Please send your payment for this amount.

Failure to

(FEIN) or Social Security No. (SSN) if you are a sole

include your payment with this application will result in a

proprietor without employees. Taxpayers are required

delay in processing your license. Licenses are not issued

to provide their taxpayer identification number (TIN)

until all fees have been paid.

on all returns and documents. A TIN is defined as the

Make checks payable to the Arizona Department of

federal employer identification number (EIN) or social

Revenue. Be sure to return all pages of the application

security number (SSN), depending upon how income

with your payment. Retain a copy of the application for your

tax is reported.

records.

4. Business DBA (doing business as) Name: Provide

DO NOT SEND CASH

the name that the business operates under. If it is the

Include your EIN or SSN on payment

same as the Legal Business Name indicate “Same”

Section D: RENTAL PROPERTIES

5. Provide the Business Phone Number including the

For businesses licensing as a Residential Rental or

area code.

Residential Rental/Property Management Co. provide a

6. Provide the Email Address for the business or contact

complete physical address for each rental property.

person.

NOTE: Residential rental properties rented for periods

of less than 30 days are taxable under the Transient

7. Provide the Date Business Started in Arizona. Provide

Lodging classification (Code 025) and are not taxable

the Date Sales Began in Arizona or estimate when you

under the Residential Rental classification according to

plan to begin selling in Arizona.

the Model City Tax Code. Transient Lodging type rentals

8. Provide the Mailing Address (number and street) where

are taxed at a different rate and require a State TPT license.

all correspondence is to be sent. You may use your

Do not use this form for properties classified as Transient

home address, corporate headquarter, or accounting

Lodging.

firm’s address, etc.

Section E: AZTAXES.GOV SECURITY ADMINISTRATOR

9. Location of Tax Records:

Indicate the physical

address where your tax records are located. Include

Complete this section to register for online services at

the company name, contact person’s name, and phone

(the Arizona Department of Revenue’s

online customer service center). The authorized users will

number with area code.

have full online access to transaction privilege tax account

10. Select the Business Type/NAICS Code from the list.

information and services. The authorized individual will

11. Provide a brief Description of Business by describing

be able to add or delete users and grant user privileges.

the major taxable business activity, principle product you

Online services include viewing tax account information,

manufacture, commodity sold, or services performed.

filing tax returns, signing returns electronically with a Self-

Select Personal Identification Number (PIN) and remitting

Section B: IDENTIFICATION OF OWNERS,

tax payments on behalf of the business identified in Section

PARTNERS, CORPORATE OFFICER(S)

A. The name and email address of the authorized user are

Provide the full name, social security number and title

required for registration.

of all Owners, Partners, Corporate Officers, Members/

Section F: REQUIRED SIGNATURES

Managing Members or Officials of the Employing Unit.

If

you need additional space, attach Additional Owners,

This application must be only signed by either a sole owner,

Partners, Corporate Officer(s) Addendum available at

at least two partners, managing member or corporate

If the owner, partners, corporate officers or

officer legally responsible for the business. This application

combination of partners or corporate officers, members and/

CANNOT be signed by agents or representatives.

or managing members own more than 50% of, or control

another business in Arizona, attach a list of the businesses,

percentages owned and unemployment insurance account

numbers or provide a General Disclosure/ Power of

Attorney (Form 285) which must be filled out and signed by

an authorized corporate officer.

NOTE: Businesses with more than one physical location are required to file electronically.

Instructions Page 2

ADOR 11186 (5/16)

1

1 2

2 3

3 4

4 5

5