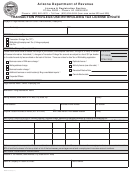

ARIZONA DEPARTMENT OF REVENUE

GENERAL INSTRUCTIONS FOR CITY ONLY APPLICATION

Note: Businesses with employees

The City Only Application is used by Arizona businesses

cannot use this form. Businesses

with business activity taxable only to cities (residential

rental, advertising, etc.) when those businesses have no

with employees must submit a

employees.

Joint Tax Application ( JT-1).

USE THIS APPLICATION TO:

Mailing Address

License New Business:

If you are conducting

Arizona Department of Revenue

business activity taxable to a city only.

PO Box 29032

Phoenix, AZ 85038-9032

Change Ownership: If acquiring or succeeding to

all or part of an existing business or changing the

Customer Service

legal form of your business (sole proprietorship to

Center Locations

corporation, etc.).

8:00 a.m. – 5:00 p.m.

Monday through Friday

IMPORTANT:

To avoid delays in processing of your

(Except legal Arizona state holidays)

application, we recommend you read these instructions

and refer to them as needed to ensure you have accurately

Phoenix Office

entered all the required information.

This application

1600 West Monroe

must be completed, signed, and returned as provided

Phoenix, AZ 85007

by A.R.S. § 23-722.

Mesa Office

Please read the form instructions while completing

1840 South Mesa Drive

the application. Additional information and forms are

Building #1352

available at

Mesa, AZ 85201

(This office does not handle billing or account

Required information is designated with an asterisk (*).

disputes)

Tucson Office

Please complete Section C:

City License Fee

400 West Congress

Worksheet to calculate and remit Total Amount Due

Tucson, AZ 85701

with this application.

Customer Service

When completing this form, please print or type in black ink.

Telephone Numbers

Legible applications are required for accurate processing.

Licensing questions on Transaction

The following numbered instructions correspond to the

Privilege, Withholding or Use Tax

numbers on the City Only Application.

(Arizona Department of Revenue)

(602) 255-3381

If you need to update a license, add a business location,

get a copy of your license, or make other changes,

complete a Business Account Update form and include a

State fee of $12 per location and any applicable fees related

to locations within the City/Town jurisdictions. Additional

information and forms are available at

Instructions Page 1

ADOR 11186 (5/16)

1

1 2

2 3

3 4

4 5

5