Department Of Defense Agency Financial Report 2007 - Section 2: Financial Information Page 59

ADVERTISEMENT

Section 2: Financial Information

Department of Defense Agency Financial Report 2007

71

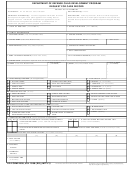

Note 17. Military Retirement and Other Federal Employment Benefits

As of September 30

2007

2006

Assumed

(Less: Assets

Present Value of

Present Value of

(amounts in millions)

Interest

Available to Pay

Unfunded Liability

Benefits

Benefits

Rate (%)

Benefits)

Pension and Health Actuarial Benefits

Military Retirement Pensions

$

1,025,320.6

6.0

$

(211,854.6)

$

813,466.0

$

963,696.1

Military Retirement Health Benefits

317,332.8

6.0

0.0

317,332.8

299,203.8

Military Medicare-Eligible Retiree Benefits

516,479.2

6.0

(107,454.2)

409,025.0

538,032.5

Total Pension and Health Actuarial Benefits

1,859,132.6

(319,308.8)

1,539,823.8

1,800,932.4

Other Actuarial Benefits

FECA

6,830.1

5.2

0.0

6,830.1

6,856.0

Voluntary Separation Incentive Programs

1,250.5

4.0

(548.6)

701.9

1,391.2

Department Education Benefits Fund

1,858.2

5.0

(1,417.8)

440.4

1,785.3

Total Other Actuarial Benefits

9,938.8

(1,966.4)

7,972.4

10,032.5

Other Federal Employment Benefits

5,608.1

(5,608.1)

0.0

4,804.6

Total Military Retirement and Other Federal

Employment Benefits

$

1,874,679.5

$

(326,883.3)

$

1,547,796.2

$

1,815,769.5

Actuarial Cost Method Used: Aggregate entry-age normal method

Assumptions: See below

Market Value of Investments in Market-based and Marketable Securities: $324.8 billion

Military Retirement Pensions

The Military Retirement Fund (MRF) is a defined benefit plan authorized by Public Law (P.L.) 98-94 to provide funds used

to pay annuities and pensions to retired military personnel and their survivors. The Board approves the long-term economic

assumptions for inflation, salary, and interest. The actuaries calculate the actuarial liabilities annually using economic

assumptions and actual experience (e.g., mortality and retirement rates). Due to reporting deadlines, the current year

actuarial present value of projected plan benefits rolls forward from the prior year’s valuation results. The Department used

the following assumptions in calculating the FY 2007 roll-forward amount.

Inflation

Salary

Interest

F iscal Year 2007

3.3% (actual)

2.2% (actual)

6.0%

F iscal Year 2008

2.3% (estimated)

3.5% (estimated)

6.0%

Long-Term

3.0%

3.75%

6.0%

Historically, the initial unfunded liability of the program was being amortized over a 50-year period. Effective FY 2008,

the initial unfunded liability will be paid over a 42-year period to ensure the annual payments cover the interest on the

unfunded actuarial liablity, with the last payment expected to be made October 1, 2025. All subsequent gains and losses

experienced by the system are amortized over a 30-year period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82