Department Of Defense Agency Financial Report 2007 - Section 2: Financial Information Page 60

ADVERTISEMENT

Department of Defense Agency Financial Report 2007

Section 2: Financial Information

72

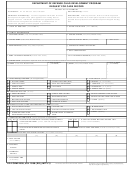

Change in MRF Actuarial Liability

(Amounts in billions)

Actuarial Liability as of 9/30/06

$963.7

Expected Normal Cost for FY 2007

17.7

Plan Amendment Liability

1.5

Assumption Change Liability

26.5

Expected Benefit Payments for FY 2007

(43.5)

Interest Cost for FY 2007

57.1

Actuarial (gains)/losses due to changes in trend assumptions

2.2

Actuarial Liability as of 09/30/07

$1,025.3

Change in Actuarial Liability

$61.6

Actuarial Cost Method Used: Aggregate entry-age normal method.

Market Value of Investments in Market-Based and Marketable Securities: $215.0 billion

Assumed Interest Rate: 6.0%

Military Retirement Health Benefits (MRHB)

The MRHB are post-retirement benefits the Department provides to non-Medicare-eligible military retirees and other eligible

beneficiaries, through private sector health care providers and Department Medical Treatment Facilities. The Department

used the following assumptions in calculating the FY 2007 actuarial liability.

Medical Trend

FY 2006 – FY 2007

Ultimate Rate FY 2031

Medicare Inpatient

6.74%

6.25%

Medicare Outpatient

6.54%

6.25%

Medicare Prescriptions (Direct Care)

6.25%

6.25%

Medicare Prescriptions (Purchased Care)

6.25%

6.25%

Non-Medicare Inpatient (Direct Care)

6.25%

6.25%

Non-Medicare Outpatient (Direct Care)

6.25%

6.25%

Non-Medicare Prescriptions (Direct Care)

6.25%

6.25%

Non-Medicare Inpatient (Purchased Care)

6.25%

6.25%

Non-Medicare Outpatient (Purchased Care)

9.48%

6.25%

Non-Medicare Prescriptions (Purchased Care)

9.84%

6.25%

Change in MRHB Actuarial Liability

(Amounts in billions)

Actuarial Liability as of 09/30/06 (Department preMedicare + all Uniformed services

Medicare cost-basis effect)

$299.2

Expected Normal Cost for FY 2007

$10.0

Expected Benefit Payments for FY 2007

($10.4)

Interest Cost for FY 2007

$19.0

Actuarial (gains)/losses due to other factors

($11.9)

Actuarial (gains)/losses due to changes in trend assumptions

$11.9

Actuarial Liability as of 09/30/07 (Department preMedicare + all Uniformed Services

Medicare cost-basis effect)

$317.3

$18.1

Change in Actuarial Liability

Actuarial Cost Method Used: Aggregate Entry-Age Normal Method

Assumed Interest Rate: 6.0%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82