Form Ffiec 009 - Country Exposure Report Page 16

ADVERTISEMENT

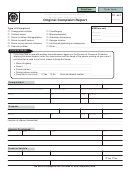

INSTRUCTIONS FOR THE PREPARATION OF THE

Country Exposure Report

FFIEC 009

Instructions

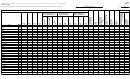

the net position of the respondent’s offices in each coun-

try vis-a ` -vis its offices in other countries; the third

(columns 15–17) calls for information on off-balance

Part I—Introduction and Summary

sheet contingencies and commitments; the fourth (col-

Description

umns 18–19) calls for information on activities of the

respondent’s offices in foreign countries; the fifth (col-

This report provides information on the distribution by

umn 20) calls for reported exposures attributable to secu-

country of foreign claims held by United States banks

rities and other assets (excluding revaluation gains) held

and bank holding companies. The individual returns are

in the respondent’s trading account; and the sixth (col-

regarded as confidential and will not be voluntarily

umn 21) calls for trade finance amounts reported in

disclosed to the public. However, aggregated data that

columns 4 and 15. In all of these sections the information

do not reveal the activities of individual banks will

is required on an individual country basis.

be published. Portions of the aggregated data are also

reported to the Bank for International Settlements as part

Column 4 of schedule 1 calls for total direct ‘‘cross-

of an international cooperative effort to compile and

border claims’’ detailed by the country of residence of

publish world-wide data on cross-border claims.

the borrower. This total for each country is broken down

in two ways: first, by the sector of borrower (bank,

The information required in the report is summarized

public, and all other) in columns 1–3; second, by matu-

below. More precise descriptions, definitions, and

rity in columns 5–7. Columns 8–10 and 11–13 indicate

instructions appear in Parts II, III, and IV of these

the extent to which the ultimate source of repayment

instructions. The definitions of items are generally con-

may be in a country other than the country of domicile of

sistent with definitions used in the Instructions for Prepa-

the direct borrower as reported in columns 1–4. Thus,

ration of the Consolidated Reports of Condition and

column 8 identifies those claims on banks reported in a

Income for Insured Commercial Banks with Domestic

particular country entry in column 1 that are guaranteed

and Foreign Offices (FFIEC 031). Any differences from

by parties in other countries. (Claims on bank branches

the definitions used in those reports are noted in the

and agencies are assumed to carry the credit ‘‘guarantee’’

appropriate paragraphs of these instructions.

of their head office. Note: Henceforth, ‘‘branches and

agencies’’ will be referred to as ‘‘branches’’). For each

The report contains two schedules: schedule 1 collects

country line, the entry in column 8 is a component of

information on the respondent’s country exposure

column 1; similarly the country entries in columns 9 and

excluding claims resulting from foreign exchange and

10 are components of columns 2 and 3, respectively. In

derivative products, which are reported in schedule 2;

columns 11–13, all the entries of columns 8-10 are

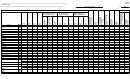

schedule 2 collects information on the respondent’s

reallocated to the country lines of the guarantors, but

country exposure resulting from revaluation gains on

with columns 11–13 distinguishing the claims by sector

foreign exchange and derivative contracts held in the

of the guarantor, in contrast to the identification of the

trading account.

sector of the direct obligor in columns 8–10. The grand

Schedule 1 has six sections: the first (columns 1–13)

total of columns 11–13 (including appropriate entries on

calls for information on the respondent’s cross-border

the U.S. line) must equal the grand total of columns

claims on foreigners; the second (column 14) calls for

8–10, but because of the shift from identification of

Instructions for Preparation of Reporting Form FFIEC 009

009-1

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36