Form Ffiec 009 - Country Exposure Report Page 30

ADVERTISEMENT

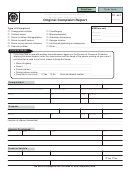

FFIEC 009

Instructions for Specific Columns of

The guaranteed or collateralized portion of a revaluation

gain is reported in the domicile country of the guarantor

Schedule 2

or in the country where the collateral is held, except

when securities are held as collateral, in which case the

Columns 1 to 4

exposure is reported in the domicile country of the issuer

of the securities. (Unlike Schedule 1, Schedule 2 does

Report revaluation gains or net positive residual amounts

not call for the reporting of gross exposures or of U.S.

in column 4 and in columns 1, 2, or 3, as appropriate. If

exposures arising from guarantors domiciled in the

respondent chooses to report separately local country

United States or from collateral held in the United

claims in columns 6 and local country liabilities in

States.)

column 7, report only cross-border claims in columns

• Refer to example 5.

1–4 (refer to instructions for columns 6 and 7). If respon-

dent chooses to report separately local country claims

When a contract is entered into with a branch of a

in column 6, report only cross-border claims in col-

commercial bank, the exposure is reported in the country

umns 1–4 (refer to instructions for columns 6 and 7).

of the head office because claims on a bank’s branches

Do not report cross-border claims that are funded by a

are, as a rule, assumed to benefit from an implicit credit

third party if the funds provider expressly agrees to

guarantee of the head office. Claims on U.S. branches of

assume the sovereign risk as verified by appropriate

foreign banks are reported in the country of the head

documentation.

office. Refer also to instructions for memorandum col-

umn 5.

If contracts are not covered by a master agreement, they

must be reported gross.

• Refer to example 1.

• Refer to example 1.

Memorandum Column 5

Reporting institutions are asked to identify in memoran-

When the reporting institution enters into a multibranch

dum column 5 claims on a bank’s branch according to

or multijurisdiction master agreement, the net residual

the domicile country of the branch, unless the claim is

amount will be reported only in column 4 (and columns

formally and legally guaranteed by the head office. Con-

1, 2, and 3, as appropriate), but refer to the instructions

tracts covered by master agreements are deemed to carry

for memorandum column 5 for the special case of juris-

the legal guarantee of the head office, even in those

dictions for which the parties to the agreement do not

jurisdictions where netting may not be enforceable, and

assume transfer risk. (The term multijurisdiction or

so, are not reported in column 5. Amounts reported in

multibranch agreement refers to a master netting agree-

column 5 are also reported in column 4 in the countries

ment that covers the head office and other offices of the

of the banks’ head offices, except when the head office is

reporting institution.) When the reporting institution

in the United States.

enters into a single netting agreement, the net residual

amount qualifies to be reported in columns 1–4, but may

For example, an unguaranteed claim on a branch of a

also qualify for reporting in columns 6 and 7 (see below)

foreign bank would be reported in column 4 in the

if the reporting institution chooses that option. (The term

country of the head office and in column 5 in the country

single netting agreement refers to a master agreement

of the branch. A claim on a foreign branch of a U.S.

entered into by a single office of the reporting institution

bank, however, would be reported only in column 5.

with another party.)

Example: The German office of the reporting institution

has a revaluation gain of $100 on a contract with the

• Refer to examples 2, 3 and 4.

local branch of a U.S. bank.

If the master netting agreement covers an office in a

jurisdiction where netting would not be enforceable,

col 4

col 5

contracts with that office should be treated as though

Germany ..........................

—

100

they were not subject to the netting agreement and

United States .....................

na

na

reported gross.

• Refer to example 2.

• Refer also to examples 1, 2 and 6.

Instructions for Preparation of Reporting Form FFIEC 009

009-15

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

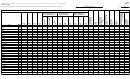

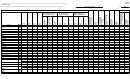

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36