Form Ffiec 009 - Country Exposure Report Page 32

ADVERTISEMENT

FFIEC 009

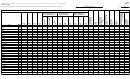

Revaluation

Revaluation

Net by

Net Aggregate

Gains

Losses

Location

Residual Amount

US Hong Kong with:

Japan Hong Kong ...............................

15

11

4

−30

Japan London ....................................

45

75

Japan Tokyo ......................................

60

40

20

−6

−6

Total ............................................

120

126

US London

Japan Hong Kong ...............................

190

70

120

Japan London ....................................

79

41

38

Japan Tokyo ......................................

67

34

33

Total ............................................

336

145

191

191

US New York

−18

Japan London ....................................

57

75

−75

Japan New York .................................

10

85

Japan Tokyo ......................................

41

40

1

−92

−92

Total ............................................

108

200

US Tokyo

−110

Japan Hong Kong ...............................

115

225

Japan London ....................................

75

25

50

−85

Japan New York .................................

15

100

Japan Tokyo ......................................

144

64

80

−65

−65

Total ............................................

349

414

Grand Total .....................................

913

885

Total Net Aggregate Residual ...........

28

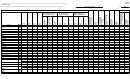

Example 1: Assumes the respondent has no master

• Since claims on Japan bank’s Hong Kong and London

agreement and elects to report to columns 6 and 7.

branches are not formally guaranteed by the head

office or covered by a master agreement, report in

memorandum column 5 gross revaluation gains with

Memo

branches of Japan bank for the countries in which the

col 4

col 5

col 6

col 7

branches are located, i.e., $320 million (in millions:

Japan ..................

769

0

144

414

$15 + $190 + $115) on the Hong Kong country line

Hong Kong ..........

0

320

0

126

and $256 million (in millions: $45 + $79 + $57 + $75)

United Kingdom ...

0

256

0

145

on the United Kingdom country line.

• Revaluation gains of 144 at US bank’s Tokyo branch

• Since respondent elects to report to columns 6 and 7,

with Japan bank’s head office in Tokyo qualify as local

report only cross-border revaluation gains in column 4:

country claims and are reported in column 6. If docu-

total gross cross-border claims of 769 on Japan bank,

mentation states that revaluation losses booked at the

including cross-border claims on the various foreign

foreign branches of US bank are payable locally (and

branches of Japan bank, are reported in column 4 in

only locally), these amounts may be reported as local

Japan, the country of the head office.

country liabilities in column 7.

Instructions for Preparation of Reporting Form FFIEC 009

009-17

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36