Form Ffiec 009 - Country Exposure Report Page 29

ADVERTISEMENT

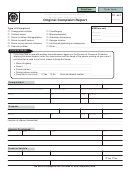

FFIEC 009

Examples for Column 18:

Column 20: Memorandum: Assets Held for Trading

Report in this memorandum column, by country, the fair

(1) The Brazilian branch of the respondent has a real-

value of the respondent’s outstanding claims reported in

denominated loan equivalent to $10 million on a

column 4 after adjustments in column 8–13 that satisfy

Brazilian bank in Brazil. Entries would be:

the coverage and definition of claims given in Part III,

definition J.

col 3

col 8

Brazil ............................

—

10

Column 21: Memorandum: Trade Financing

(2) The Brazilian branch of the respondent has a dollar-

Report in this memorandum column, by country, the

denominated loan for $10 million on a Brazilian

claims and commitments reported in columns 1–4 and 15

bank in Brazil. Entries would be:

that satisfy the coverage and definition of claims given in

Part III, definition F.

col 1

col 18

Brazil ............................

—

10

SCHEDULE 2

(3) The London branch of the respondent has a real-

Report by country outstanding claims on foreigners that

denominated claim equivalent to $10 million on a

represent the revaluation gains from marking to market

bank in Brazil. Entries would be:

interest rate, foreign exchange, and other off-balance

sheet commodity and equity contracts held for trading

col 1

col 18

purposes. Revaluation gains can be offset against revalu-

Brazil ............................

10

—

ation losses if the transactions were executed with the

same counterparty under a legally enforceable master

netting agreement. When contracts are covered by mas-

Column 19: Local Country Liabilities

ter netting agreements, the net residual amount, if posi-

tive, is reported in the domicile country of the counter-

Report in this column, by country, the liabilities of the

party. No entries on Schedule 2, however, are appropriate

respondent’s foreign offices that represent legal obliga-

for the United States and the country line for the United

tions of the foreign offices and for which no payment is

States is blocked out on the schedule.

guaranteed at locations outside of the country of the

office; for example, deposits with a foreign branch that

For purposes of this report, netting is accomplished

do not carry a cross-border guarantee are assumed to be

according to the procedures and requirements, including

the legal liabilities of the foreign branch only and are to

those covering the use of collateral and the treatment of

be paid at that branch. Local country liabilities may be to

transactions involving jurisdictions in which netting may

residents or non-residents and payable in local or non-

not be enforceable, set forth in the following cites for the

local currencies. Exclude revaluation losses on foreign

risk-based capital rules:

exchange and derivative products, which should be

national banks:

12 CFR Part 3, Appendix A

reported in Schedule 2.

state member banks: 12 CFR Part 208, Appendix A

Example for Column 19:

bank holding

companies:

12 CFR Part 225, Appendix A

(1) The Argentine branch of the respondent has a

insured commercial

$10 million claim. The claim is funded by local

banks:

12 CFR Part 325, Appendix A

dollar-denominated deposits and the respondent bank

The netting criteria for a valid right of setoff contained in

does not explicitly assume the sovereign risk. Entries

FASB Interpretation No. 39, which is also indicated for

would be:

reporting revaluation gains and losses on a net basis in

col 3

col 18

col 19

the Call Report, may be followed in this report if this

results in no material differences from the results

Argentina ...............

—

10

10

obtained from following the risk-based capital rules.

Instructions for Preparation of Reporting Form FFIEC 009

009-14

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36