Form Ffiec 009 - Country Exposure Report Page 33

ADVERTISEMENT

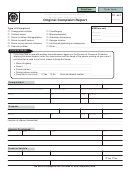

FFIEC 009

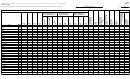

Example 2: Assume the respondent has a master netting

• Report the total net aggregate residual amount of 28 in

agreement. In addition, assume for illustrative purposes

column 4 for Japan. In reporting exposure to a bank

that netting is not enforceable in Hong Kong.

covered by a master netting agreement, the amount

reported in column 4 in the country of the head office

represents total exposure to the organization as a

Memo

whole, including amounts that may be payable only at

col 4

col 5

branches of the organization.

Japan .............................

449

0

• Should a sovereign event occur in Hong Kong prevent-

Hong Kong .....................

0

0

ing offices there from making payments outside Hong

UK ................................

0

0

Kong, it is assumed that US bank would most likely

net Japan bank’s transactions with its Hong Kong

• Aggregate the net residual amounts for the London,

branch and its transactions with Japan bank’s Hong

New York, and Tokyo offices of US bank and Japan

Kong branch and that the resulting net amount would

bank; that is, 38 + 33 − 18 − 75 + 1 + 50 − 85 + 80 = 24.

be paid (or received) in Hong Kong. A net gain at US

Contracts with US bank’s Hong Kong branch and

bank’s London branch with Japan Hong Kong (120), a

contracts with Japan bank’s Hong Kong branch are

net loss at its Tokyo branch with Japan Hong Kong

treated as though they were not subject to the netting

(−110), and the net loss at US bank’s Hong Kong

agreement. Report gross revaluation gains of 120 at

branch (−6) with all offices of Japan bank result in a

US Hong Kong, 190 at US London, and 115 at US

net exposure in Hong Kong of 4, which should be

Tokyo plus 24 in aggregate net amounts on other

reported in memorandum column 5 for Hong Kong.

contracts (449 total) in column 4 for Japan.

Example 4: Master netting, no exceptions. As in

• No amounts are required to be reported in memoran-

examples 2, and 3, reporting to columns 6 and 7 is not

dum column 5 because the master agreement between

appropriate.

US bank and Japan bank is assumed to obligate the

parties to meet the obligations of their respective

Memo

branches, even in jurisdictions where netting is not

col 4

col 5

enforceable.

Japan ...............................

28

0

• No amounts qualify as local country assets or liabili-

Hong Kong .......................

0

0

UK ..................................

0

0

ties to be reported in columns 6 or 7; contracts covered

United States .....................

na

na

by multibranch master agreements result in cross-

border claims or liabilities of the head office.

• Report the net positive residual amount of 28 in col-

umn 4 as exposure in Japan.

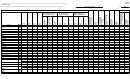

Example 3: Respondent has a master netting agreement,

Example 5: Same as example 4, except that parties have

but parties do not assume the cross-border risk in Hong

also agreed to a bilateral collateralization agreement

Kong; that is, they decline to guarantee payment of

under which exposures greater than 10 are collateralized

obligations of their Hong Kong branches outside of

with cash or highly liquid U.S. Government securities

Hong Kong. As in example 2, reporting in columns 6 and

held in New York. Assume that collateral is pledged in

7 is not appropriate.

minimum incremental amounts of 5.

Memo

Memo

col 4

col 5

col 4

col 5

Japan ...............................

28

0

Japan ...............................

8

0

Hong Kong .......................

0

4

Hong Kong .......................

0

0

UK ..................................

0

0

UK ..................................

0

0

United States .....................

na

na

United States .....................

na

na

Instructions for Preparation of Reporting Form FFIEC 009

009-18

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36