Form Ffiec 009 - Country Exposure Report Page 35

ADVERTISEMENT

FFIEC 009

covered by a master agreement do not have to be

Memo

reported in memorandum column 5.

col 4

col 5

col 6

col 7

• The net gains with the Hong Kong and UK corporate

Hong Kong ..........

79

60

15

126

customers do not qualify to be reported as local coun-

UK ....................

60

79

190

111

try claims in column 6, because under the multibranch

Argentina ............

0

0

0

0

master agreement these claims are properly regarded

Venezuela ............

10

0

0

0

as those of US bank’s head office.

Singapore ............

45

0

0

0

• Report in column 4 cross border exposures: in Hong

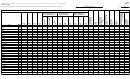

Example 9: Assumes respondent does not have a multi-

Kong, 79 to the London branch of Hong Kong Bank,

branch agreement but its Hong Kong branch has single

domiciled in Hong Kong; in the United Kingdom,

netting agreements with the Hong Kong and Singapore

60 to the Hong Kong branch of UK Bank, domiciled in

corporate customers. Netting is not enforceable in

the United Kingdom; in Argentina, 0 (the exposure to

Argentina and Venezuela and respondent chooses to

Argentine corporate customer is formally guaranteed

report in columns 6 and 7.

by its U.S. parent); in Venezuela, 10; and in Singapore,

45.

Memo

• Report in column 5 claims on branches of UK bank

col 4

col 5

col 6

col 7

(60) and Hong Kong bank (79) in the countries of

Hong Kong ..........

79

60

4

70

these particular branches.

Singapore ............

0

0

0

0

United Kingdom ...

60

79

190

111

• Report in columns 6 and 7 local country assets of 15 in

Argentina ............

57

0

0

0

Hong Kong and 190 in the United Kingdom and, if

Venezuela ............

10

0

0

0

appropriately documented, local country liabilities to

both residents and nonresidents of 126 in Hong Kong

• Report in column 4 gross cross-border exposures of 79

and 111 in the United Kingdom.

in Hong Kong, 60 in the United Kingdom, 57 in

Argentina, and 10 in Venezuela.

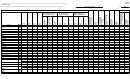

Example 8: Assumes the respondent has a multibranch

• Report in memorandum column 5 the exposure of

master agreements with all counterparties, but netting is

60 in Hong Kong to the Hong Kong branch of UK

not enforceable in Argentina and Venezuela. Respondent

bank and the exposure of 79 in the United Kingdom to

elects to report in columns 6 and 7.

the London branch of Hong Kong bank. These expo-

sures are also reported in column 4 in the countries of

Memo

the head offices.

col 4

col 5

col 6

col 7

• Report in column 6 as a local country asset the net

Hong Kong ..........

42

0

0

0

claim of 4 of US bank’s Hong Kong branch on the

Singapore ............

0

0

0

0

United Kingdom ...

140

0

0

0

Hong Kong corporate customer, since transactions

Argentina ............

57

0

0

0

between these parties are covered by a single netting

Venezuela ............

10

0

0

0

agreement which does not involve US bank’s head

office in New York. The claim of US bank’s London

branch on the UK corporate of 190 also qualifies to be

• In column 4 report net gains of 42 in Hong Kong and

reported in column 6 as a local country asset.

140 in the United Kingdom and gross gains in Argen-

tina (57) and Venezuela (10), since netting is assumed

• Report in column 7 as local country liabilities in Hong

not to be enforceable in Argentina and Venezuela.

Kong, provided they are payable locally, the net loss of

30 of US bank’s Hong Kong branch with the Singapore

• The net claims on the Hong Kong branch of UK bank

corporate and the loss of 40 of US bank’s Hong Kong

and London branch of Hong Kong bank are reported in

the countries of their head offices and since these are

branch with the Hong Kong branch of UK bank.

Instructions for Preparation of Reporting Form FFIEC 009

009-20

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36