Form Ffiec 009 - Country Exposure Report Page 28

ADVERTISEMENT

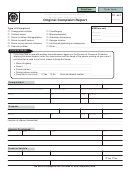

FFIEC 009

office the net liabilities (or claims) of those offices on all

Column 16: Commitments in Column (15) Head

other offices of the respondent that are located in other

Office/Guarantor in Another Country

countries (e.g., the net amount a German branch has

Report in column 16 those letters of credit and other

‘‘due to’’ or ‘‘due from’’ the head office and any other

commitments issued by the respondent to residents of

consolidated non-German office of the parent). Only a

each country reported in column 15 that involve poten-

single net figure should be reported for all the offices of

tial claims on customers that would, in turn, be guaran-

the respondent in a given country. If the offices in a given

teed (as defined in Part III definition C) by residents of

country taken together have a net ‘‘due to’’ position with

other countries, including the United States. The foreign

all related offices in all other countries combined, a

country entries in column 16 are components of the same

positive figure should be reported; a net ‘‘due from’’

country entries in column 15. However, column 16 of the

position should be indicated by brackets. For the pur-

United States line is not a component of column 15,

poses of this report, the computation of net due to or due

which has no entries for the United States line. The

from should include unremitted profits and capital of

United States line of column 16 should include any

branch offices as well as total equity of majority-owned

binding commitments to lend or otherwise provide funds

subsidiaries.

to U.S. branches of foreign banks or to other U.S. entities

The amounts reported in column 14 represent the inter-

where repayment of amounts to be extended under com-

nal position of offices within the consolidated bank

mitments are guaranteed by residents of other countries.

or the consolidated holding company. They are, there-

fore, not reflected in any other columns of the report,

Column 17: Redistribution of Commitments in

which represents a fully consolidated position of the

Column (16) to County(s) of Head Office/Guarantor

respondent.

In column 17, reallocate to the guarantor countries

(including the United States and each international or

Column 15: Commitments

regional institution), the amounts of letters of credit and

This column requires reporting of the respondent’s bind-

other commitments reported in column 16 that involve

ing commitments that may result in cross-border claims.

guarantees issued by residents of other countries. The

Report in column 15, by country of the account party, all

total of column 17 must equal the total of column 16.

contractual commitments such as legally binding lines

of credit and formal guarantees (as defined in Part III,

Column 18: Local Country Claims on Local

definition C). Report in this column, by country of

Residents

account party, all outstanding commercial letters of credit

issued or confirmed (as defined in Part III, definition E).

Report in this column, on each foreign country line,

Exclude advised letters of credit. Exclude any such let-

outstanding claims of the respondent’s foreign offices

ters of credit issued on behalf of U.S. residents. Also

that are on residents of the country in which the offices

report by country of the account party, all (a) outstanding

are located. Include claims denominated in both local

standby letters of credit issued or confirmed and

currency and non-local currency (e.g., Belgian franc or

(b) amounts outstanding of purchases of risk participa-

U.S. dollar loans to residents of Belgium by a Belgian

tions in acceptances (as defined in Part III, definition C).

branch of the respondent). Report all amounts in U.S.

Exclude any such guarantees of obligations of U.S. resi-

dollar equivalents. These amounts are reported only in

dents. Do not include in this column any foreign-office

column 18 and are not reflected in any other columns of

local and non-local currency commitments on local resi-

the report. Entries would be made in column 18 for a

dents unless the reporting institution anticipates that such

particular country line only if the reporting bank has a

commitments may result in cross-border claims (such as

branch or subsidiary in that country. Exclude revaluation

commercial letters of credit). Exclude any such commit-

gains on foreign exchange and derivative contracts.

ments that cover obligations of U.S. residents. Exclude

These should be reported only in schedule 2. Exclude

cross-border commitments (such as those under commer-

foreign office claims on local residents that are guaran-

cial letters of credit) that can be cancelable, at the option

teed by residents of other countries and claims on local

of the reporting institution, upon occurrence of a sover-

branches of foreign banks. These should be reported in

eign event.

columns 1–3.

Instructions for Preparation of Reporting Form FFIEC 009

009-13

December 1997

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36