Clear Form

Form 2, Page 3 - 2008

Social Security Number:

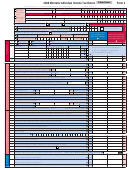

Voluntary Check-off Contributions

Check the appropriate box(es) below if you wish to contribute in addtition to your existing tax liability.

Please enter the total amount on Form 2, line 67.

67a. Nongame Wildlife Program

$5 ►

$10 ►

or specify amount ►

67b. Child Abuse Prevention

$5 ►

$10 ►

or specify amount ►

67c. Agriculture in Schools

$5 ►

$10 ►

or specify amount ►

67d. End-stage Renal Disease Program

$5 ►

$10 ►

or specify amount ►

67e. Montana Military Family Relief Fund

$5 ►

$10 ►

or specify amount ►

Total voluntary check-off contributions.

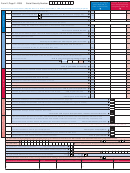

2008 Montana Individual Income Tax Table

If your taxable income is more than

but not more than

multiply your taxable income by

and subtract

equals your tax

$0

$2,600

1% (0.010)

$0

$2,600

$4,600

2% (0.020)

$26

$4,600

$7,000

3% (0.030)

$72

$7,000

$9,500

4% (0.040)

$142

$9,500

$12,200

5% (0.050)

$237

$12,200

$15,600

6% (0.060)

$359

more than $15,600

6.9% (0.069)

$499

For example: Taxable income $6,800 X 3% (0.030) = $204; $204 minus $72 = $132 tax

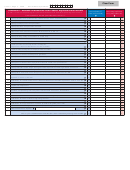

Column A (for single,

Column B (for spouse

Schedule I - Montana Additions to Federal Adjusted Gross Income

joint, separate, or

when fi ling separately

Enter on the corresponding line your additions to federal adjusted gross income.

head of household)

using fi ling status 3a)

File Schedule I with your Montana Form 2.

1

Interest and mutual fund dividends from state, county, or municipal bonds from other states.

1

1

2

Dividends not included in federal adjusted gross income.

2

2

3

Taxable federal refunds. Complete Worksheet II on page 51.

3

3

4

Other recoveries of amounts deducted in earlier years that reduced Montana

taxable income. Complete Worksheet IX (available at mt.gov/revenue).

4

4

5

Addition to federal taxable social security/railroad retirement.

Complete Worksheet VIII on page 55.

5

5

6

Sole proprietor’s allocation of compensation to spouse.

6

6

Medical care savings account nonqualifi ed withdrawals.

7

7

7

8

First-time home buyer savings account nonqualifi ed withdrawals.

8

8

9

Farm and ranch risk management account taxable distributions.

9

9

10

Addition for dependent care assistance credit adjustment.

10

10

Addition for smaller federal estate and trust taxable distributions.

11

11

11

12

Federal net operating loss carryover reported on Form 2, line 21.

12

12

13

Share of federal income taxes paid by your S corporation.

13

13

14

Title plant depreciation and amortization.

14

14

Premiums for Insure Montana Small Business Health Insurance credit.

15

15

15

16

Other additions. Specify:

16

16

17

Add lines 1 through 16. Enter total here and on Form 2, line 38.

17

17

This is your total Montana additions to federal adjusted gross income.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9