Clear Form

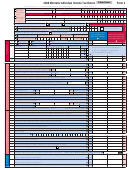

Form 2, Page 8 - 2008

Social Security Number:

Column A (for single,

Column B (for spouse

Schedule VI - Credit for an Income Tax Liability

joint, separate, or

when fi ling separately

Paid to Another State or Country - Full-year Resident Only

head of household)

using fi ling status 3a)

File Schedule VI with your Montana Form 2.

1 Enter your income taxable to another state or country that is included in Montana adjusted

gross income on Form 2, line 40. Where applicable, this includes your share of income taxes

paid that were claimed as a deduction by your S corporation or partnership.

1

1

2 Enter your total income from the other state or country you used in calculating your

income tax paid to that state or country. Include in this total all income exempt from

Montana income tax that was subject to tax in the other state or country.

Indicate state’s abbreviation.

(abr.)

(abr.)

2

2

3 Enter your total Montana adjusted gross income from Form 2, line 40. Where applicable,

this includes your share of income taxes paid that are claimed as a deduction by your

S corporation or partnership.

3

3

4 Enter your total income tax liability paid to the other state or country.

4

4

5 Enter your Montana tax liability from Form 2, line 48.

5

5

6 Divide line 1 by line 2. Enter the percentage here, but not more than 100%.

6

6

7 Multiply line 4 by line 6 and enter the result here.

7

7

8 Divide line 1 by line 3. Enter the percentage here, but not more than 100%.

8

8

9 Multiply line 5 by line 8 and enter the result here.

9

9

10 Enter here and on Form 2, Schedule V, line 1, the smaller of the amounts

reported on lines 4, 7, or 9 above.

10

10

This is your credit for an income tax paid to another state or country.

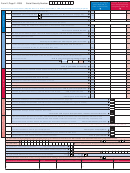

Column A (for single,

Column B (for spouse

Schedule VII - Credit for an Income Tax Liability

joint, separate, or

when fi ling separately

Paid to Another State or Country - Part-year Resident Only

head of household)

using fi ling status 3a)

File Schedule VII with your Montana Form 2.

1 Enter your income taxable to another state or country that is included in Montana source

income on Form 2, Schedule IV, line 16, total Montana source income. Where applicable,

this includes your share of income taxes paid that were claimed as a deduction by your

S corporation or partnership.

1

1

2 Enter your total income from the other state or country you used in calculating your

income tax paid to that state or country. Include in this total all income exempt from

Montana income tax that was subject to tax in the other state or country.

Indicate state’s abbreviation.

(abr.)

(abr.)

2

2

3 Enter your total Montana source income from Form 2, Schedule IV, line 16.

Where applicable, this includes the share of income taxes paid that are claimed

as a deduction by your S corporation or partnership.

3

3

4 Enter your total income tax liability paid to the other state or country.

4

4

5 Enter your Montana tax liability from Form 2, line 48a.

5

5

6 Divide line 1 by line 2. Enter the percentage here, but not more than 100%.

6

6

7 Multiply line 4 by line 6 and enter the result here.

7

7

8 Divide line 1 by line 3. Enter the percentage here, but not more than 100%.

8

8

9 Multiply line 5 by line 8 and enter the result here.

9

9

10 Enter here and on Form 2, Schedule V, line 1, the smaller of the amounts

reported on lines 4, 7, or 9 above.

10

10

This is your credit for an income tax paid to another state or country.

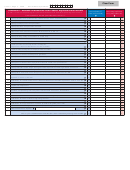

You are not entitled to a Montana tax credit for taxes paid to a

•

This is a nonrefundable credit and cannot reduce your Montana

foreign country if you claimed these foreign taxes paid as a foreign

tax liability below zero.

tax credit on your federal income tax return.

•

This is a nonrefundable single year credit. No unused credit

•

If you claim this credit for an income tax paid by your

amount can be carried forward.

S corporation or partnership see the instructions for Form 2,

•

You will need to complete a separate Schedule VI or VII for

Schedule V, line 1 on page 40.

each state or country that you have paid an income tax liability

•

Your credit is limited to an income tax liability paid on income

to. You cannot combine payments on one schedule.

that is also taxed by Montana.

•

If you are a part-year resident, you have to allocate your income

•

Your income taxes paid include excise taxes or franchise taxes

using Form 2, Schedule IV before completing Form 2, Schedule

that are imposed on and measured by the net income of your

VII.

S corporation or partnership.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9