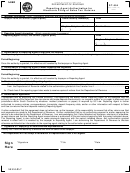

Form St-554 - Reporting Agent Authorization For Electronic Filing Of Sales Tax Returns Page 2

ADVERTISEMENT

Instructions for ST-554

General Instructions

Purpose of Form

ST-554 is used to facilitate electronic filing of sales tax returns with the South Carolina Department of Revenue.

Discussing taxpayer information beyond the scope of ST-554 requires an SC2848 Power of Attorney executed by the

taxpayer.

ST-554 is used to authorize a reporting agent to:

Sign and file certain returns;

Make deposits and payments for certain returns;

Receive duplicate copies of tax information, notices, and other written and/or electronic communication regarding any

authority granted; and

Provide the Department with information to aid in penalty relief determinations related to the authority granted on

ST-554.

Authority Granted

Once ST-554 is signed, any authority granted is effective beginning with the period indicated on lines 3 & 4 and continues

indefinitely unless revoked by the taxpayer or reporting agent. No authorization or authority is granted for periods prior to

the period(s) indicated on ST-554. Disclosure authority granted is effective on the date ST-554 is signed by the taxpayer.

Any authority granted on ST-554 does not revoke and has no effect on any authority granted pursuant to SC2848 Power

of Attorney.

Specific Instructions

Line 1 - Taxpayer Information

Individuals. Enter your name, SSN or FEIN, and address in the space provided.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to

use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201

mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers,

as prescribed, for securing proper identification. Your social security number is used for identification purposes.

Corporations, partnerships, or LLC's. Enter the name, FEIN, and business address.

Line 2 - Reporting Agent Information

Enter the name of your reporting agent(s). Only individuals may be named as reporting agents. Use the identical name

on all submissions. If you want to name more than three reporting agents, indicate so on this line and attach a list of

additional reporting agents to the form. Be sure to sign and date all attachments.

Line 5 - Disclosure of Information to Reporting Agents

Box a authorizes the reporting agent to receive or request copies of tax information and other communications

from the Department of Revenue related to the authorization granted.

Box b authorizes the reporting agent to receive copies of notices from the Department of Revenue.

Line 6 - Authorization Agreement

Be sure to read the Authorization Agreement in its entirety before signing.

Line 7 - Signature of Taxpayer(s) or Authorized Representative

You must sign and date the Reporting Agent Authorization.

Who Must Sign

Corporations or associations. An officer having authority to bind the taxpayer must sign.

Partnerships. All partners or members of an LLC must sign unless one partner or member is authorized to act in the

name of the partnership. A partner is authorized to act in the name of the partnership if, under state law, the partner

has authority to bind the partnership. A copy of such authorization must be attached. For dissolved partnerships, see

US Treasury Regulations section 601.503(c)(6).

Other. If the taxpayer is a dissolved corporation, deceased, insolvent, or a person for whom or by whom a fiduciary (a

trustee, guarantor, receiver, executor, or administrator) has been appointed, see US Treasury Regulations section

601.503(d).

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2