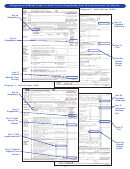

Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 21

ADVERTISEMENT

Attachment Sequence No. 1040-03

2007

MISSOURI DEPARTMENT OF REVENUE

CREDIT FOR INCOME TAXES PAID TO

FORM

MO-CR

OTHER STATES

OR POLITICAL SUBDIVISIONS

Complete this form for you and your spouse, if you and/or your

• Attach a copy of all income tax returns for each state or

spouse have income from another state or political subdivision.

political subdivision.

If you had multiple credits, complete a separate form for each

• Attach Form MO-CR to Form MO-1040.

state or political subdivision.

YOUR NAME

YOUR SOCIAL SECURITY NO.

YOUR SPOUSE’S NAME

SPOUSE’S SOCIAL SECURITY NO.

YOURSELF

SPOUSE

1. Claimant’s total adjusted gross income

00

00

(Form MO-1040, Line 5Y and/or Line 5S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Claimant’s Missouri income tax

00

00

(Form MO-1040, Line 25Y and/or Line 25S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

USE TWO LETTER ABBREVIATION FOR STATE OR

STATE OF:

STATE OF:

See table on back.

NAME OF POLITICAL SUBDIVISION.

00

00

3. Wages and commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

00

4. Other (describe nature)

. . . . . . . . . . . . . . . . . . . . . .

4

00

00

5. Total — Add Lines 3 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

6. Less: related adjustments (from Federal Form 1040A, Line 20, OR Federal Form 1040, Line 36). .

6

00

00

7. Net amounts — Subtract Line 6 from Line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

%

%

8. Percentage of your income taxed — Divide Line 7 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

00

9. Maximum credit — Multiply Line 2 by percentage on Line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Income tax you paid to another state or political subdivision. This is not tax withheld.

00

00

The income tax is reduced by all credits, except withholding and estimated tax. . . . . . . . . . . . . . .

10

11. Credit — Enter the smaller amount of Line 9 or Line 10 here and on Form MO-1040,

Line 26Y or Line 26S. (If you have multiple credits, add the amounts

00

00

on Line 11 from each Form MO-CR before entering on Form MO-1040 . . . . . . . . . . . . . . . . . .

11

MO 860-1095 (12-2007)

For Privacy Notice, see page 44 of the instructions.

Attachment Sequence No. 1040-03

2007

MISSOURI DEPARTMENT OF REVENUE

CREDIT FOR INCOME TAXES PAID TO

FORM

MO-CR

OTHER STATES

OR POLITICAL SUBDIVISIONS

Complete this form for you and your spouse, if you and/or your

• Attach a copy of all income tax returns for each state or

spouse have income from another state or political subdivision.

political subdivision.

If you had multiple credits, complete a separate form for each

• Attach Form MO-CR to Form MO-1040.

state or political subdivision.

YOUR NAME

YOUR SOCIAL SECURITY NO.

YOUR SPOUSE’S NAME

SPOUSE’S SOCIAL SECURITY NO.

YOURSELF

SPOUSE

1. Claimant’s total adjusted gross income

00

00

(Form MO-1040, Line 5Y and/or Line 5S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Claimant’s Missouri income tax

00

00

(Form MO-1040, Line 25Y and/or Line 25S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

USE TWO LETTER ABBREVIATION FOR STATE OR

STATE OF:

STATE OF:

NAME OF POLITICAL SUBDIVISION.

See table on back.

00

00

3. Wages and commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

00

4. Other (describe nature)

. . . . . . . . . . . . . . . . . . . . . .

4

00

00

5. Total — Add Lines 3 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

6. Less: related adjustments (from Federal Form 1040A, Line 20, OR Federal Form 1040, Line 36). .

6

00

00

7. Net amounts — Subtract Line 6 from Line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

%

%

8. Percentage of your income taxed — Divide Line 7 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

00

9. Maximum credit — Multiply Line 2 by percentage on Line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Income tax you paid to another state or political subdivision. This is not tax withheld.

00

00

The income tax is reduced by all credits, except withholding and estimated tax. . . . . . . . . . . . . . .

10

11. Credit — Enter the smaller amount of Line 9 or Line 10 here and on Form MO-1040,

Line 26Y or Line 26S. (If you have multiple credits, add the amounts

00

00

on Line 11 from each Form MO-CR before entering on Form MO-1040 . . . . . . . . . . . . . . . . . .

11

MO 860-1095 (12-2007)

For Privacy Notice, see page 44 of the instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44